问题如下:

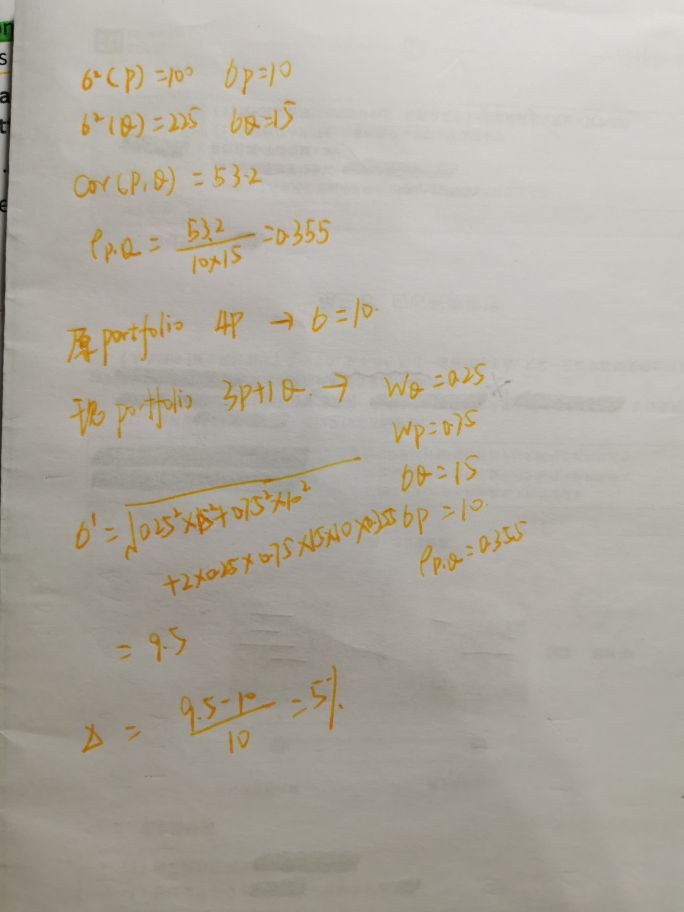

You are given the following information about the returns of stock P and stock Q: variance of return of stock P=100; variance of return of stock Q=225; covariance between the return of stock P and the return of stock Q=53.2. At the end of 1999, you are holding USD 4 million in stock P. You are considering a strategy of shifting USD 1 million into stock Q and keeping USD 3 million in stock P. What percentage of risk, as measured by standard deviation of return, can be reduced by this strategy?

选项:

A.

0.5%

B.

5.0%

C.

7.4%

D.

9.7%

解释:

The variance of the original portfolio is 1,600, implying a volatility of 40. The new portfolio has variance of . This gives a volatility of 38, which is a reduction of 5%.

请问,按照原波动率为10,组合后根据权重计算的组合的波动率为9.5,波动率降低0.5,相比于10,降低了0.5/10=5%,这样计算对吗?