问题如下:

6. Based on Exhibit 2, the total return from the long position in natural gas futures is closest to:

选项:

A.1.46%

3.71%

4.14%

解释:

A is correct.

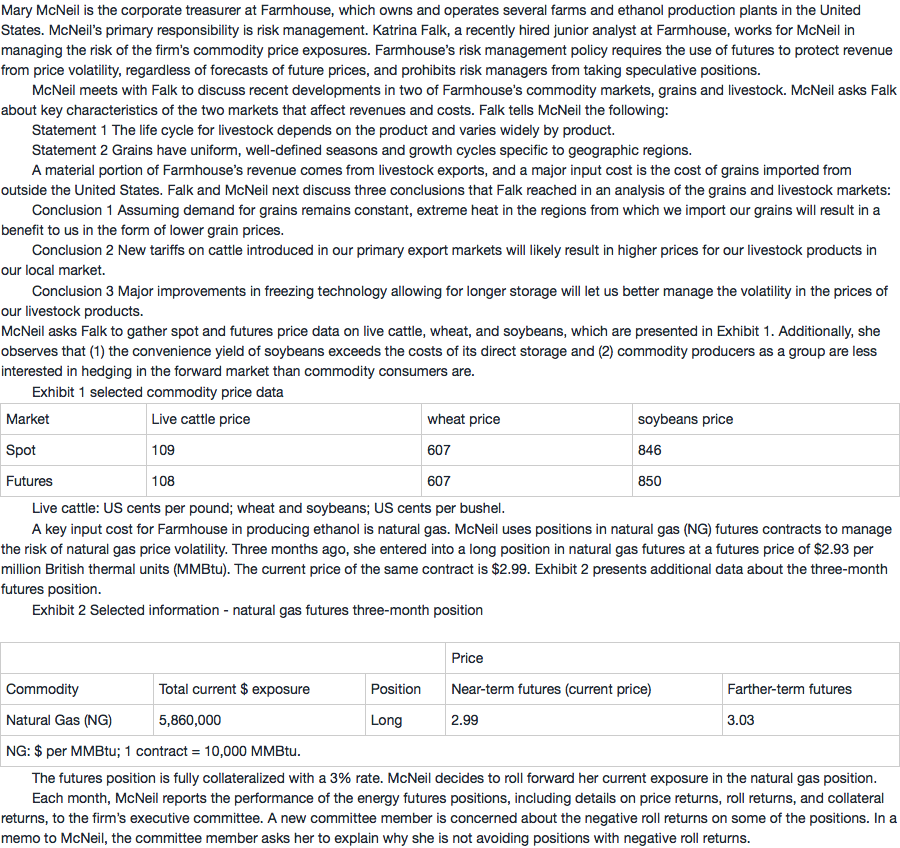

The total return for a fully collateralized position is the sum of the price return, the roll return, and the collateral return:

Price return = (Current price – Previous price)/Previous price = (2.99 – 2.93)/2.93 = 2.05%.

Roll return = (Near-term futures closing price – Farther-term futures closing price)/Near-term futures closing price × Percentage of position in futures contract being rolled = [(2.99 – 3.03)/2.99] × 100% = –1.34%.

Collateral return = Annual rate × Period length as a fraction of the year = 3% × 0.25 = 0.75%.

Therefore, the total return for three months = 2.05% – 1.34% + 0.75% = 1.46%.

为什么collateral return要乘以0.25?