问题如下:

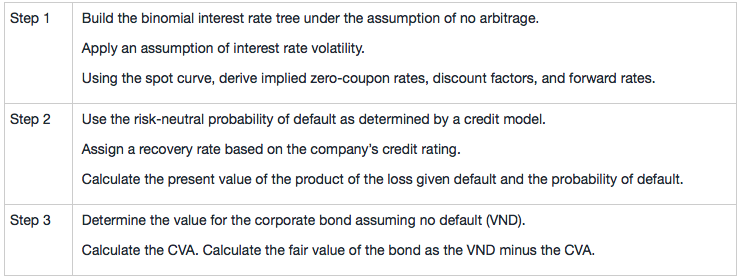

Thames reminds Cromwell that her model assumes zero interest rate volatility and a flat government yield curve. Cromwell responds that Thames should relax these unrealistic assumptions. Thames outlines the steps to take in valuing risky bonds under this scenario in Exhibit 1.

EXHIBIT 1 STEPS IN VALUING RISKY BONDS, ARBITRAGE-FREE FRAMEWORK

Which step in Exhibit 1 regarding valuing risky bonds has Thames most likely outlined correctly?

选项:

A.Step 1.

Step 2.

C.Step 3.

解释:

Thames is correct in describing Step 3 but incorrect about both Step 1 and Step 2.

The third point in

Step 1 is explained incorrectly. The par curve where each bond is priced at par

value, not the spot curve, is used to derive implied zero-coupon rates. In the

second point of Step 2, she is incorrect regarding the recovery rate. The

assumption is not based on credit ratings. The recovery rate if default were to

occur should conform to the seniority of the debt issue and the nature of the

issuer’s assets. For instance, a firm with a high ratio of assets relative to

the debt level and debt senior in the capital structure will result in a higher

recovery for bondholders than one with the reverse situation.

这道题在考什么?