问题如下:

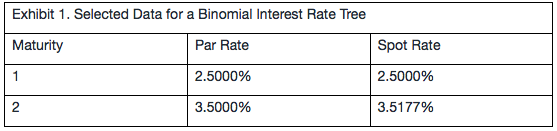

Based on data in Exhibit 1, to calibrate a binomial interest rate tree starting with the calculation of implied forward rates shown in Exhibit 2.

Based on Exhibits 1 and 2, the value of the lower one-period forward rate is closest to:

选项:

A.3.5122%.

B.3.5400%.

C.4.8037%.

解释:

B is correct.

考点:考察利率二叉树模型

解析

需要计算的是Time 1时间点下面节点的利率,因为Volatility为25%,直接通过关系式可得:

0.058365 × e(-0.5) = 0.035400=3.5400%.

我想问下老师,怎么知道Volatility为25%的

我的做法是用已知的spot rate计算出forward rate,也就是1时刻的midrate,然后1时刻的大的利率除以midrate算下来的比例,再来计算小的利率