问题如下:

3. Based on Exhibit 1 and White’s notes, which of the following is least consistent with White’s conclusion regarding Bema’s announcement?

选项:

A.Bema’s bonding costs will be higher than Aquarius’s.

B.Bema will have a lower degree of operating leverage than does Aquarius.

C.Bema will have a lower percentage of tangible assets to total assets than does Aquarius.

解释:

B is correct.

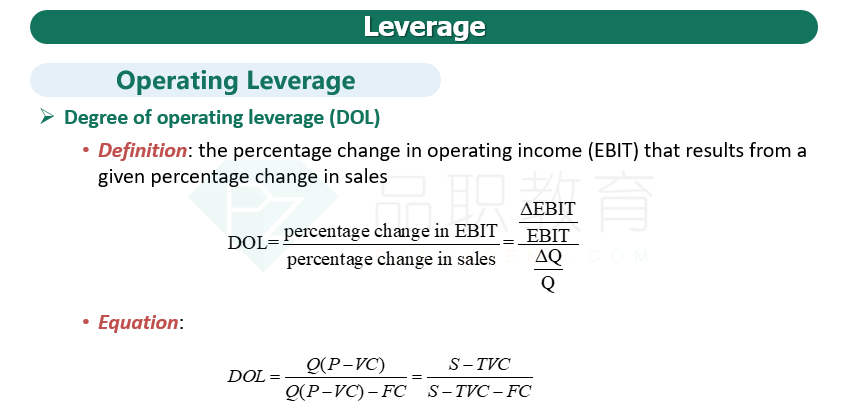

If Bema’s degree of operating leverage declines relative to that of Aquarius, Bema’s business risk will also decline relative to Aquarius. All else being equal, this decline would be expected to increase Bema’s market value relative to Aquarius; e.g., by decreasing Bema’s cost of equity.

老师,B选项只是一个假设是么? 因为B选项说的那个lower operating leverge我看和题目矛盾, 两个公司的debt to equity ratio 都是0.6,所以看到B选项就蒙了