问题如下:

Testa acquired

a Spanish packaging company. The Spanish investment involved Testa acquiring

200,000 shares of a packaging company at EUR90 per share. He decided to fully

hedge the position with a six month USD/EUR forward contract. Details of the

euro hedge at initiation and three months later are provided in Exhibit 1.

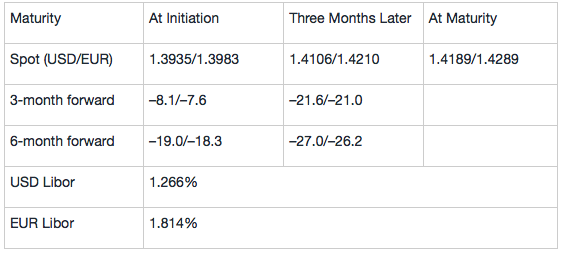

Exhibit 1 2009 Spot and Forward USD/EUR Quotes (Bid-Offer) and Annualized Libor Rates

Using Exhibit 1, if the Spanish shares had been sold after three months,how would the manager do to close the initial transaction?

选项:

A.Sell EUR 18 million at spot.

B.Sell EUR 18 million three months forward.

C.Buy EUR 18 million three months forward.

解释:

C is correct.

考点:Mark-to-market value of Forward Contract

解析:0时刻为了对冲USD/EUR的外汇风险,签订6个月远期合约,头寸为卖欧元,合约的面值为200,000* EUR90 per share= EUR 18m,

3个月后,为了提早结束之前签订的远期合约,所以签订3个月的反向对冲合约,买欧元,合约面值仍为EUR 18m。 所以C选项正确。

为什么六个月的合约是卖欧元呢?6个月后不是应该卖美元买欧元来买股票吗?