问题如下:

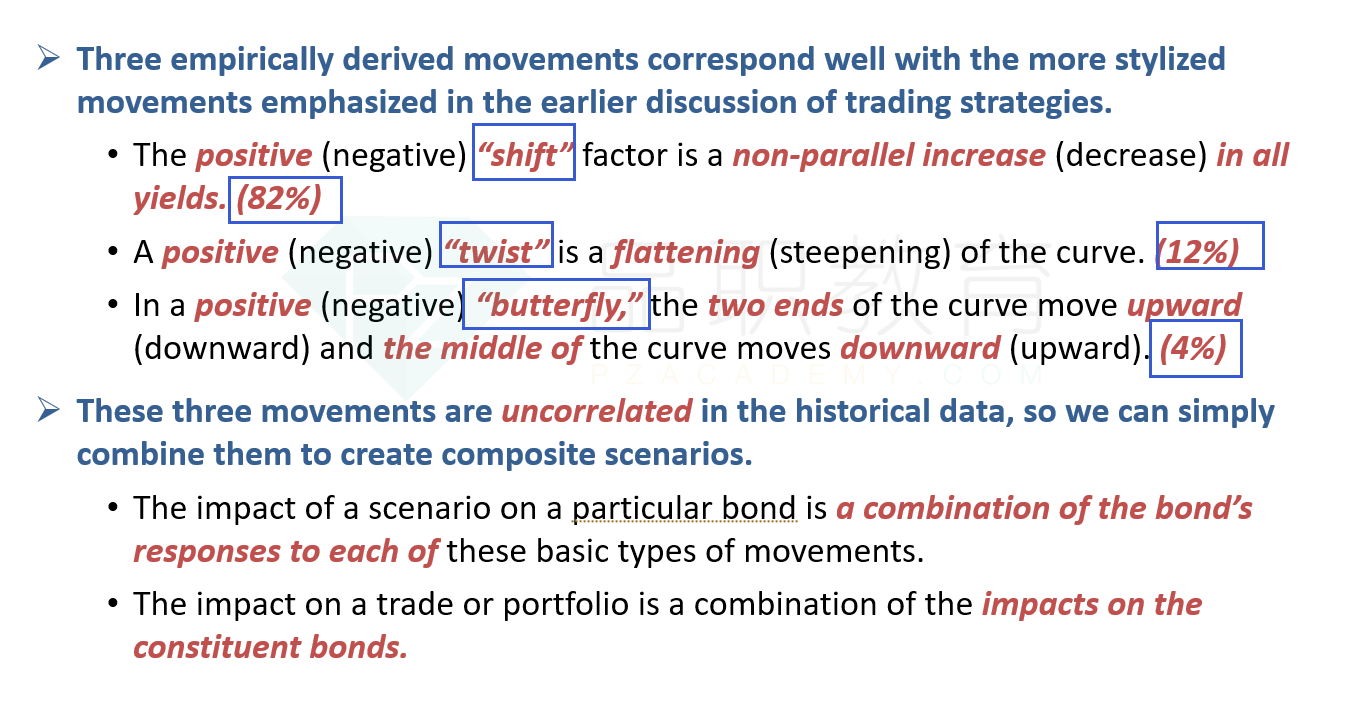

The most likely ranking of the yield curve components shown in Exhibit 2 from highest to lowest percentage of overall curve movements explained is:

选项:

A.Component A, then Component B, then Component C.

B.Component B, then Component C, then Component A.

C.Component C, then Component A, then Component B.

解释:

C is correct.

Component (C) is a "shift" in which all yields move in the same direction by similar, though not exactly equal, amounts. The shift is by far the dominant component of yield curve movements. Duration, which assumes shifts are actually parallel, derives its importance as risk measure from this fact. Component (A) is a "twist" in which the ends of the yield curve move in opposite directions while the middle of curve stays roughly unchanged. The twist is the second most important type of yield curve movement. Bond managers focus on barbells versus bullets during twist-induced changes in the slope of the yield curve. Component (B) is a "butterfly" movement in which the ends of the yield curve move in the same direction and the middle of the curve moves in the opposite direction. While meaningful butterflies are less important than twists and much less important than shifts in terms of explaining overall movements of the yield curve. Butterflies are driven in part by changes in yield volatility.

A is incorrect. Component (C) is a "shift," which is by far the most important component of yield curve movements. Component (A) is a "twist," which is more important than Component (B), which is a "butterfly" movement.

B is incorrect. Component (C) is a "shift," which is by far the most important component of yield curve movements. Component (A) is a "twist," which is more important than Component (B), which is a "butterfly" movement.

请问这道题怎么看出来ABC的变动方向的?benchmark是什么?