问题如下:

5. Based on Exhibit 2, Quinni’s best answer to Varden’s question about the effect of adding a third independent variable is:

选项:

A.no for R2 and no for adjusted R2.

B.yes for R2 and no for adjusted R2.

C.yes for R2 and yes for adjusted R2.

解释:

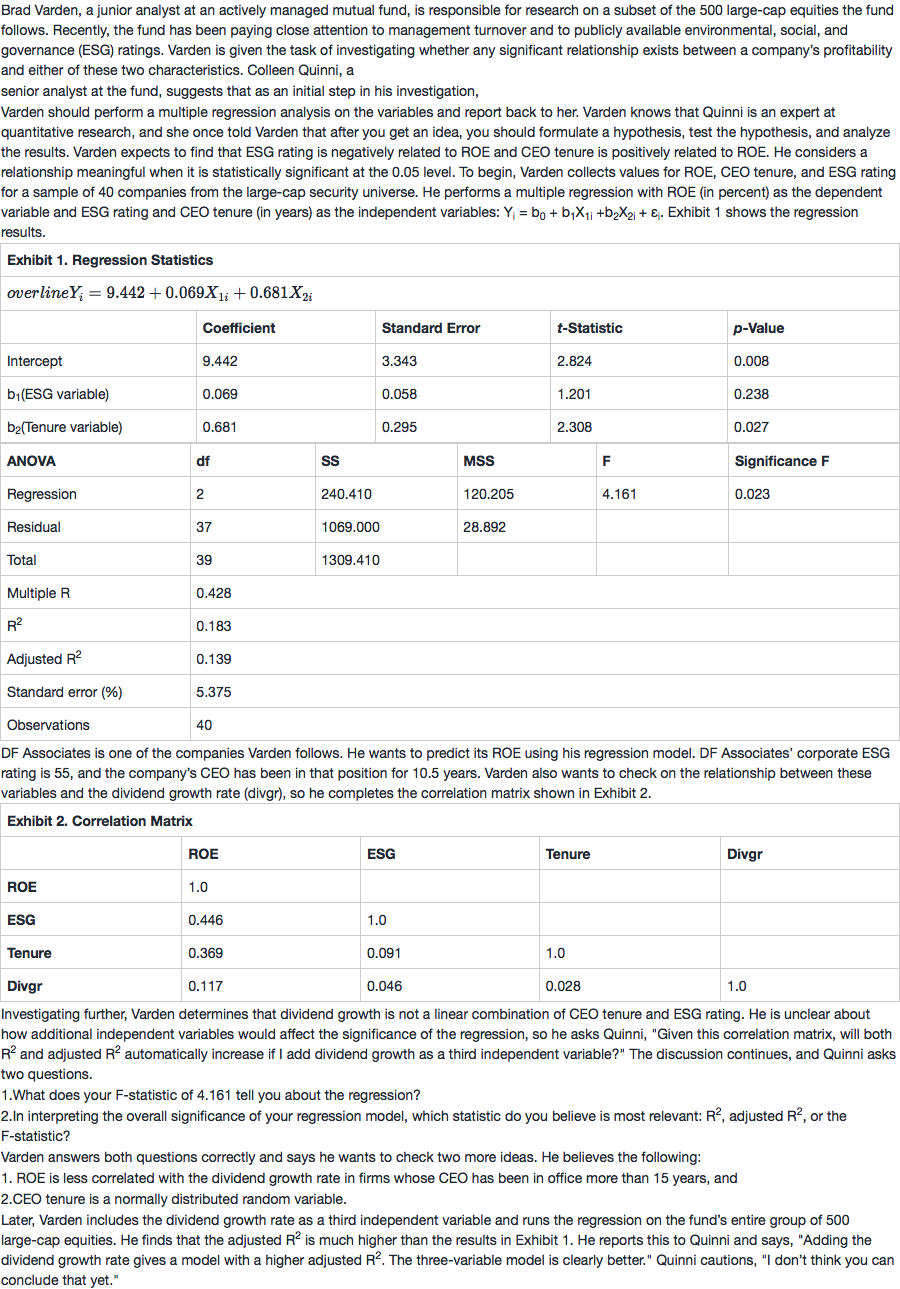

B is correct. When you add an additional independent variable to the regression model, the amount of unexplained variance will decrease, provided the new variable explains any of the previously unexplained variation. This result occurs as long as the new variable is even slightly correlated with the dependent variable. Exhibit 2 indicates the dividend growth rate is correlated with the dependent variable, ROE. Therefore, R2 will increase.

Adjusted R2, however, may not increase and may even decrease if the relationship is weak. This result occurs because in the formula for adjusted R2, the new variable increases k (the number of independent variables) in the denominator, and the increase in R2 may be insufficient to increase the value of the formula.

看了前面的解答,想问下,这个题不用计算具体的adjusted R2就可以直接得结论吗?