问题如下:

Which of the following asset will outperform when economy slows and inflation becomes low?

选项:

A.Private equity

Real estate

Government bonds

解释:

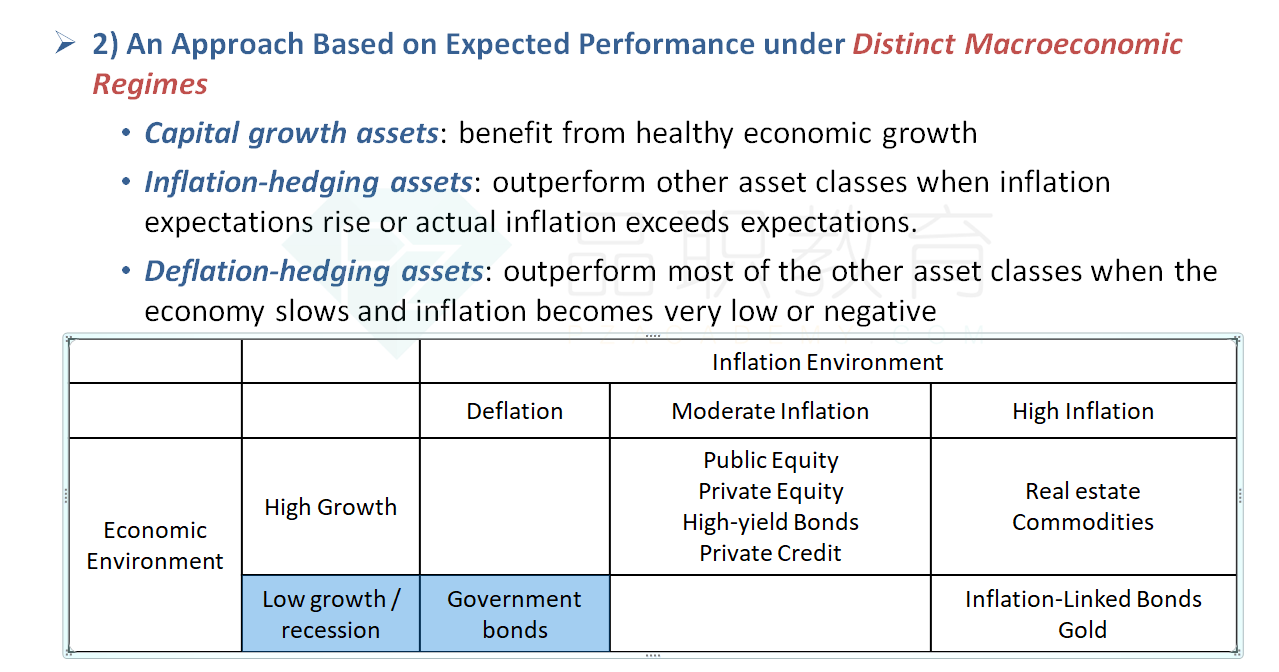

C is correct.

Government bonds belongs to deflation-hedging assets. When economy slows and inflation becomes low, it will outperform than other assets.

inflation becomes low = Deflation ?

Deflation = negative inflation?

请问这个怎么理解