问题如下:

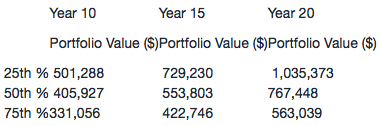

Açor reviews a recent risk tolerance questionnaire completed by Njau, which relates to overall portfolio risk. Açor focuses on the type of capital sufficiency analysis to perform for Njau. To determine the optimal allocation, Açor seeks to ensure that Njau’s charitable pledge can be met and implements a goal- based investing approach. Açor runs a Monte Carlo simulation to determine the probability of success, which is the likelihood that Njau can meet her charitable pledge objective. The simulation results are presented in Exhibit 2.

Açor’s portfolio allocation for Njau is most likely optimized on the basis of:

选项:

A.a stated maximum level of volatility.

B.total portfolio mean–variance efficiency.

C.the results of the risk tolerance questionnaire.

解释:

A is correct. Açor uses the goal- based investing approach by allocating with a focus on Njau’s charitable pledge to Udhamini. With this method, she seeks to optimize Njau’s portfolio so that the pledge goal has a high probability of being met. Açor will set aside a required amount of funds to invest, and a mean–variance optimization will be run specifically for that portion of Njau’s portfolio. The funds will be invested to a stated maximum level of volatility to meet the charitable need.

您好,看了之前的答案,对其中的一句解释有一些疑问:“最终使得目标投资组合被优化到一个指定的最大波动水平(风险)或一个特定的成功概率。“,我想问的是,为什么最后会将投资组合优化到一个指定的最大波动水平上呢?”最大波动水平(风险)“难道不是一个不好的东西吗?优化到这个结果是图什么呢?谢谢