问题如下:

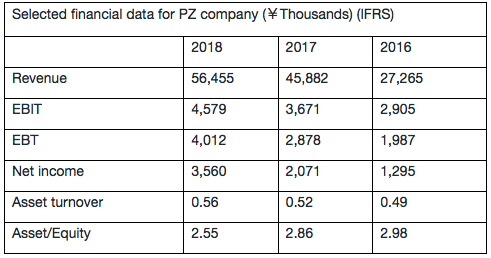

Analyst collected the financial information about PZ company in the following table:

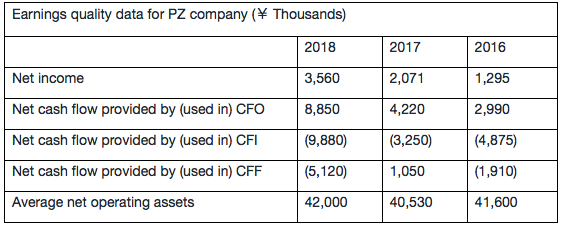

Analyst also collected the cash flow information about PZ company in the following table:

The CFF includes cash paid for interest of 1260 and the CFO includes taxes of 1850 in 2018, please calculate the ratio of operating cash flow before interest and taxes to operating income for PZ for 2018 is closet to:

选项:

A.2.29

B.2.25

C.2.34

解释:

C is correct.

考点:operating cash flow before interest and taxes

解析:

Operating cash flow before interest and taxes=CFO+支付利息的现金+支付税的现金,这一题比较特殊,因为题目中说interest是属于financing activity的,不属于CFO,所以它没有在CFO中扣除。既然它没有在CFO中扣除,那也就不需要加回了.只需要加回tax即可,

Operating cash flow before interest and taxes=8850+1850=10700

将其除以EBTI得到:10700/4579=2.34

OCF=CFO+int paid+tax paid,这里的int paid可否从I/S中EBIT-EBT获得int paid?还是说题干已明确说明int paid在CFF中扣除,所以不用在CFO中加回?顺便在问下EBIT-EBT等于567 为什么和CFF里的int paid数字不一样?