问题如下:

Under U.S. GAAP, cash flow from operations is:

选项:

A.$75,000.

B.$100,000.

C.$115,000.

解释:

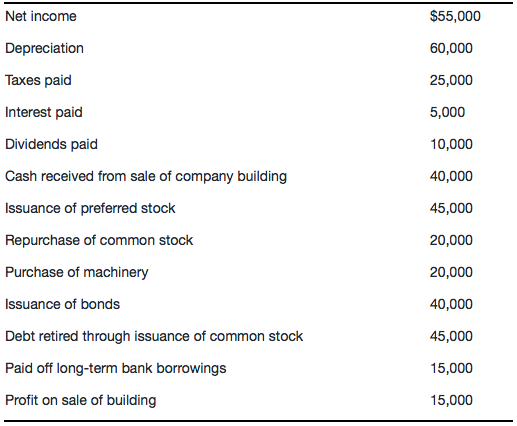

CFO=Net income - profit on sale of building + depreciation = 55,000 - 15,000 + 60,000 = $100,000

The profit on the sale of the building should be subtracted from net income, and that taxes and interest are already deducted in calculating net income.

老师, profit on sale of building=15,000 是属于I/S里的non-operating items的gain。 那如果换种表达, cash received from sale of building 减去building的history value也等于 15,000,是否算作G/L要算入CFO里呢?