问题如下:

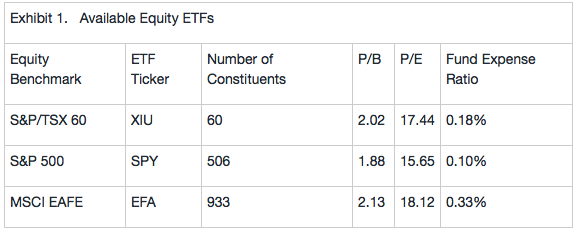

Winthrop and Tong agree

that only the existing equity investments need to be liquidated. Tong suggests

that, as an alternative to direct equity investments, the new equity portfolio

be composed of the exchange-traded funds (ETFs) shown in Exhibit 1.

Based

on Exhibit 1 and assuming a full-replication indexing approach, the tracking

error is expected to be highest for:

选项:

A.XIU

SPY

EFA

解释:

An index that contains a large number of constituents will tend to

create higher tracking error than one with fewer constituents. Based on the

number of constituents in the three indexes (S&P/TSX 60 has 60, S&P 500

has 506, and MSCI EAFE has 933), EFA (the MSCI EAFE ETF) is expected to have

the highest tracking error. Higher expense ratios (XIU: 0.18%; SPY: 0.10%; and EFA:

0.33%) also contribute to lower excess returns and higher tracking error, which

implies that EFA has the highest expected tracking error.

怎么去区分讲义里76页讲的?我看到有别的学员也提了类似的问题,但是解答并没有说清楚,讲义里也没有说什么我们构建组合数量和index里数量的区别?而且讲义的这张图,我没记错的话,去年李老师还画错了(画错的时候,还是一样这么讲的),后来又改的,这就把我搞的很混乱,再配上这个题目,更混乱了。