问题如下:

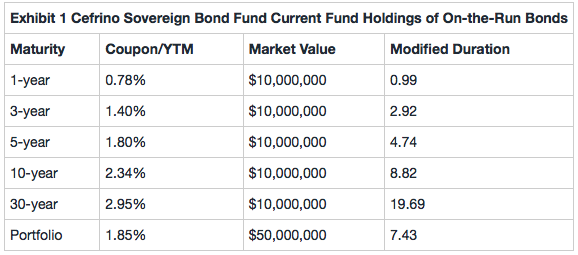

Silvia Abram and Walter Edgarton are analysts with Cefrino Investments, which sponsors the Cefrino Sovereign Bond Fund (the Fund). Abram and Edgarton recently attended an investment committee meeting where interest rate expectations for the next 12 months were discussed. The Fund’s mandate allows its duration to fluctuate ±0.30 per year from the benchmark duration. The Fund’s duration is currently equal to its benchmark. Although the Fund is presently invested entirely in annual coupon sovereign bonds, its investment policy also allows investments in mortgage-backed securities (MBS) and call options on government bond futures. The Fund’s current holdings of on-the-run bonds are presented in Exhibit 1.

Over the next 12 months, Abram expects a stable yield curve; however, Edgarton expects a steepening yield curve, with short-term yields rising by 1.00% and long-term yields rising by more than 1.00%.

Based on Exhibit 1 and Abram’s expectation for the yield curve over the next 12 months, the strategy most likely to improve the Fund’s return relative to the benchmark is to:

选项:

A.buy and hold

increase convexity

ride the yield curve

解释:

C is correct.

Since Abram expects the curve to remain stable, the yield curve is upward sloping and the Fund’s duration is neutral to its benchmark. Her best strategy is to ride the yield curve and enhance return by capturing price appreciation as the bonds shorten in maturity.

老师您好,请问这道题里面提到了Edgarton expects a steepening yield curve,已经不满足riding the yield curve的条件,为什么答案选C不选B呢