问题如下:

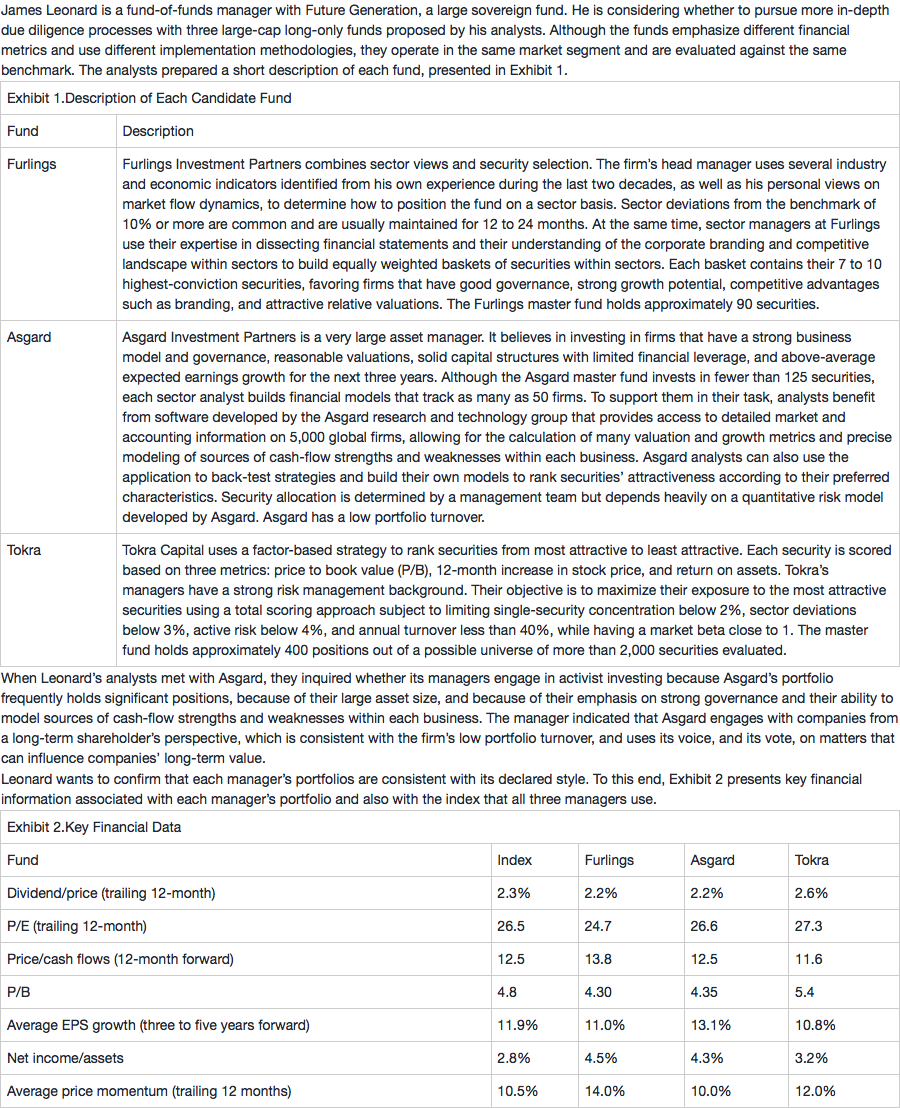

Which of the following statements about the approaches and styles of either Furlings, Asgard, or Tokra is incorrect?

选项:

A.Furlings is a top-down sector rotator with a value orientation within sectors.

B.Asgard is a bottom-up manager with a GARP (growth at a reasonable price) style.

C.Tokra is a factor-based manager using value, growth, and profitability metrics.

解释:

C is an incorrect statement. Although Tokra is a factor manager, and although it uses a value proxy such as P/B and a profitability proxy such as return on assets, it does not use a growth proxy such as earnings growth over the last 12 or 36 months but rather a price momentum proxy.

A is a correct statement. Furlings is a top-down manager. It makes significant sector bets based on industry and economic indicators derived from the head manager’s experience, and it does select its securities within sectors while considering relative valuation.

B is a correct statement. Asgard favors securities that have reasonable valuations and aboveaverage growth prospects. It has a bottom-up approach and builds its portfolio starting at the security level.

老师你好,这道题BC理解了,但是A选项中的top down 怎么看出是value导向的呢?