问题如下:

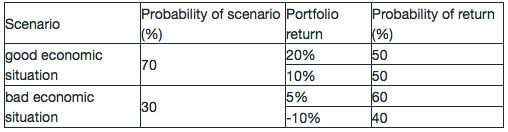

Maud, an analyst of an investment company, she made two scenarios of portfolio returns under different economic situations:

The expected portfolio return is closest to:

选项:

A.14.0%

B.10.2%.

C.5.2%

解释:

Good economic situation scenario: The expected return = 20%×50%+10%×50%=15%

Bad economic situation scenario: The expected return=5%×60%+(-10%)×40%= -1%

The general expected return=70%×15%+30%×(-1%)=10.2%.

老师,我列的式子是这样的,0.7*0.2*0.5+0.7*0.1*0.5+0.3*0.05*0.6+0.3*(-0.1)*0.4

这样计算和答案确实不符,但不明白为什么不可以这样计算?70%那部分其实和最后的是相符的,就是后面30%部分按这个方法与答案不符,我猜想应该是先计算概率再乘以30%有扩大负数的原因,但不明白为什么不能按这个式子算?