竹子 · 2017年10月22日

对于该公司而言是回购方,所以它支付回购价格1010,买入了账面价值为980的债券,支付价格高于债券的账面价值,所以是LOSS。但这里要注意,在美国准则下,发行成本不计入资产的账面价值中,而是单独的一项,所以还需要 减去这一部分的成本。所以一共的LOSS是1010-980+24。

比如你出售一件商品,出售成本2块钱,现在这个商品价值8块,你又用12块钱买回来,这个业务你一共付出的14块钱,买了一个8块钱的东西,所以LOSS是6块。这个例子不是很严谨,但你可以类比一下。

ciaoyy · 2018年02月08日

老师,你举得第一个例子里面,算出来的数字为正数。为什么说是loss呢?(如果不从回购价>面值这个角度来看,单纯从公式角度看,G/L=回购价-账面价值,得出的+为gain,-为loss)

竹子 · 2018年02月09日

你可以对比一下答案中倒数第二行的公式,对于购买方而言,肯定是东西的账面价值大于他所支付的钱,这样才是gain啊

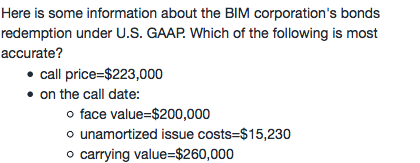

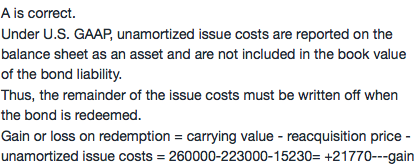

NO.PZ2016012102000199 问题如下 Here is some information about the BIM corporation's bon remption unr U.S. GAAP. Whiof the following is most accurate? call price=$223,000 on the call te: favalue=$200,000 unamortizeissue costs=$15,230 carrying value=$260,000 A.Report a gain of $21,770. B.Report a loss of $17,500. C.Report a gain of $37,000. A is correct.Unr U.S. GAAP, unamortizeissue costs are reporteon the balansheet asset anare not incluin the book value of the bonliability.Thus, the remainr of the issue costs must written off when the bonis reemeGain or loss on remption = carrying value - reacquisition pri- unamortizeissue costs = 260000-223000-15230= +21770---gain考点 发行成本摊销和核销 在美国准则下,债券的发行成本将作为一项资产,确认在B/S上,然后逐年摊销到I/S中。因此,当债券被赎回时,剩余的未摊销完毕的发行成本也要一核销written off。赎回的Gain or Loss = 账面价值 - 回购金额 - 未摊销的发行成本 = 260 k = 223 k - 15.23 k = 21.77k 。 账面价值carrying value是260000,赎回价格是223000,不应该直接用carrying value-call price就可以了吗

NO.PZ2016012102000199 问题如下 Here is some information about the BIM corporation's bon remption unr U.S. GAAP. Whiof the following is most accurate? call price=$223,000 on the call te: favalue=$200,000 unamortizeissue costs=$15,230 carrying value=$260,000 A.Report a gain of $21,770. B.Report a loss of $17,500. C.Report a gain of $37,000. A is correct.Unr U.S. GAAP, unamortizeissue costs are reporteon the balansheet asset anare not incluin the book value of the bonliability.Thus, the remainr of the issue costs must written off when the bonis reemeGain or loss on remption = carrying value - reacquisition pri- unamortizeissue costs = 260000-223000-15230= +21770---gain考点 发行成本摊销和核销 在美国准则下,债券的发行成本将作为一项资产,确认在B/S上,然后逐年摊销到I/S中。因此,当债券被赎回时,剩余的未摊销完毕的发行成本也要一核销written off。赎回的Gain or Loss = 账面价值 - 回购金额 - 未摊销的发行成本 = 260 k = 223 k - 15.23 k = 21.77k 。 这道题为什么还要减去未摊销部分

NO.PZ2016012102000199 问题如下 Here is some information about the BIM corporation's bon remption unr U.S. GAAP. Whiof the following is most accurate? call price=$223,000 on the call te: favalue=$200,000 unamortizeissue costs=$15,230 carrying value=$260,000 A.Report a gain of $21,770. B.Report a loss of $17,500. C.Report a gain of $37,000. A is correct.Unr U.S. GAAP, unamortizeissue costs are reporteon the balansheet asset anare not incluin the book value of the bonliability.Thus, the remainr of the issue costs must written off when the bonis reemeGain or loss on remption = carrying value - reacquisition pri- unamortizeissue costs = 260000-223000-15230= +21770---gain考点 发行成本摊销和核销 在美国准则下,债券的发行成本将作为一项资产,确认在B/S上,然后逐年摊销到I/S中。因此,当债券被赎回时,剩余的未摊销完毕的发行成本也要一核销written off。赎回的Gain or Loss = 账面价值 - 回购金额 - 未摊销的发行成本 = 260 k = 223 k - 15.23 k = 21.77k 。 老师,您好,我想问下哈,为什么不是用favalue减呀,我觉得如果是call的话,那么赚的不应该是面值减去call的价格吗。谢谢

NO.PZ2016012102000199问题如下Here is some information about the BIM corporation's bon remption unr U.S. GAAP. Whiof the following is most accurate? call price=$223,000 on the call te: favalue=$200,000 unamortizeissue costs=$15,230 carrying value=$260,000 A.Report a gain of $21,770. B.Report a loss of $17,500. C.Report a gain of $37,000. A is correct.Unr U.S. GAAP, unamortizeissue costs are reporteon the balansheet asset anare not incluin the book value of the bonliability.Thus, the remainr of the issue costs must written off when the bonis reemeGain or loss on remption = carrying value - reacquisition pri- unamortizeissue costs = 260000-223000-15230= +21770---gain考点 发行成本摊销和核销 在美国准则下,债券的发行成本将作为一项资产,确认在B/S上,然后逐年摊销到I/S中。因此,当债券被赎回时,剩余的未摊销完毕的发行成本也要一核销written off。赎回的Gain or Loss = 账面价值 - 回购金额 - 未摊销的发行成本 = 260 k = 223 k - 15.23 k = 21.77k 。 赎回的Gain or Loss = 账面价值 - 回购金额 - 未摊销的发行成本 = 260 k = 223 k - 15.23 k = 21.77kcarrying value 市场价值call pri赎回价格favalue 面值 = pvalue以上理解是否正确,请教!

NO.PZ2016012102000199 Report a loss of $17,500. Report a gain of $37,000. A is correct. Unr U.S. GAAP, unamortizeissue costs are reporteon the balansheet asset anare not incluin the book value of the bonliability. Thus, the remainr of the issue costs must written off when the bonis reeme Gain or loss on remption = carrying value - reacquisition pri- unamortizeissue costs = 260000-223000-15230= +21770---gain 考点 发行成本摊销和核销 在美国准则下,债券的发行成本将作为一项资产,确认在B/S上,然后逐年摊销到I/S中。 因此,当债券被赎回时,剩余的未摊销完毕的发行成本也要一核销written off。 赎回的Gain or Loss = 账面价值 - 回购金额 - 未摊销的发行成本 = 260 k = 223 k - 15.23 k = 21.77k 。 这道题的carry value 是net book value 吗?还是指初始融资金额,尚未摊销?