问题如下:

Li is a portfolio manager who manages a large fund. The duration of the fund is allowed to fluctuate ±0.2 from its benchmark duration and the fund’s current duration equals to that of benchmark. The mandate of the fund allows it to purchase options but does not allow it to write options. The information about the portfolio’s current on-the-run position is shown below:

Li expects that over the next 12-month, the yield curve will remain stable. According to the information above, which of the following strategies will earn the highest return relative to the portfolio’s benchmark?

选项:

A.Buy and hold

B.Buy short-term at-the money options on long-term bond futures

C.Riding the yield curve.

解释:

C is correct.

考点:Stable yield curve对应合适的策略

解析:从当前On-the-run债券的收益率曲线可以看出,当前状态下,yield curve是upward sloping的,并且Li预测,这个yield curve会是Stable的,持续至未来12个月。则已知这两个条件下,合适的策略是Riding the yield curve. 对于B选项,是购买期限较短(时间价值较小)、ATM的期权,期权的标的物是Long-term bond的期货合约,这样的期权其Convexity较大,因此B选项是增加了整个Portfolio的 Convexity;由于预测的是Stable的yield curve,可知B选项的策略无法增强收益。

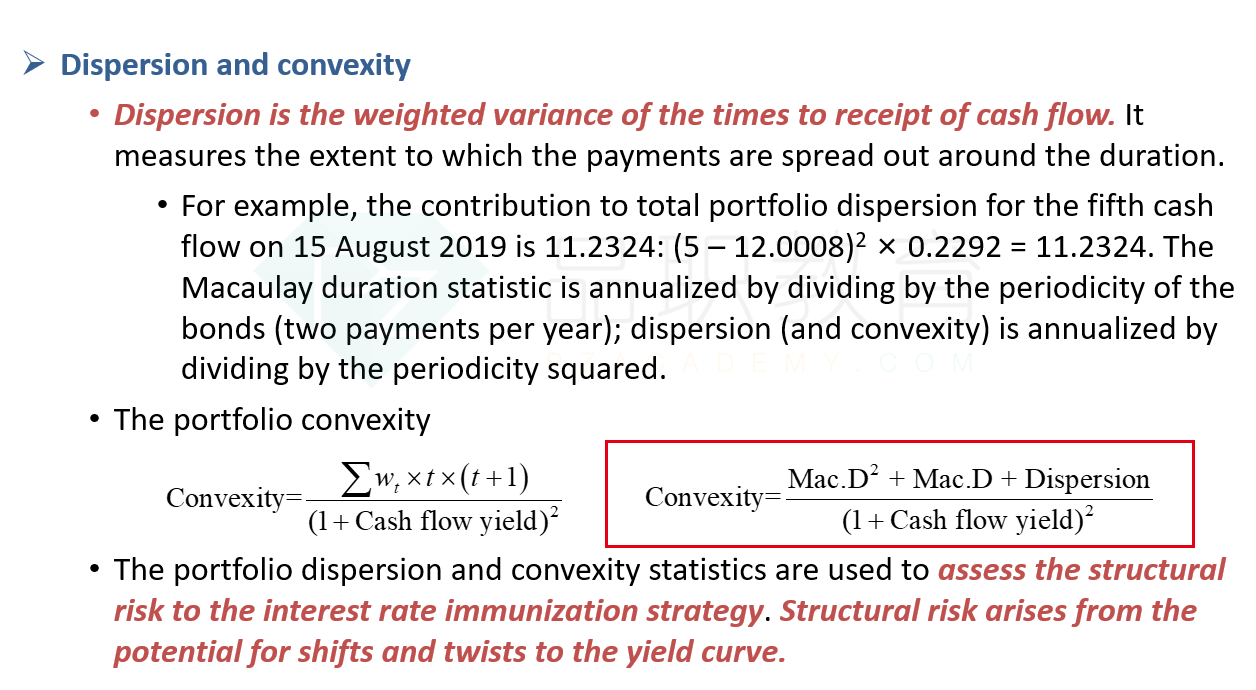

期权的标的物是Long-term bond的期货合约,这样的期权其Convexity较大,因此B选项是增加了整个Portfolio的 Convexity;

已經忘記 想請教老師 Duration 和 Convexity 成正比嗎? Duration 越大Convexity 越大嗎? 謝謝老師!