问题如下:

In the meeting with Maglav, Azarov describes the investment approach used by Westcome in managing the pension plan. The approach is characterized by a high allocation to alternative investments, significant active management, and a reliance on outsourcing assets to other external asset managers. Azarov also explains that Maglav’s operating results have a low correlation with pension asset returns and that the investment strategy is affected by the fact that the pension fund assets are a small portion of Maglav’s market capitalization. Azarov states that the plan is subject to the Employee Retirement Income Security Act of 1974 (ERISA) and follows generally accepted accounting principles, including Accounting Standards Codification (ASC) 715, Compensation—Retirement Benefits.

Westcome’s investment approach for Maglav’s pension plan can be best characterized as the:

选项:

A.Norway model.

B.Canadian model.

C.endowment model.

解释:

C is correct.

The endowment model operates in an asset-only context and is characterized by a high allocation to alternative investments, including private investments and hedge funds; significant active management; and outsourcing to external managers. These characteristics describe the investment approach used by Westcome. The skill in sourcing alternative investments is critically important given the large variation in performance among asset managers, especially for alternative investments.

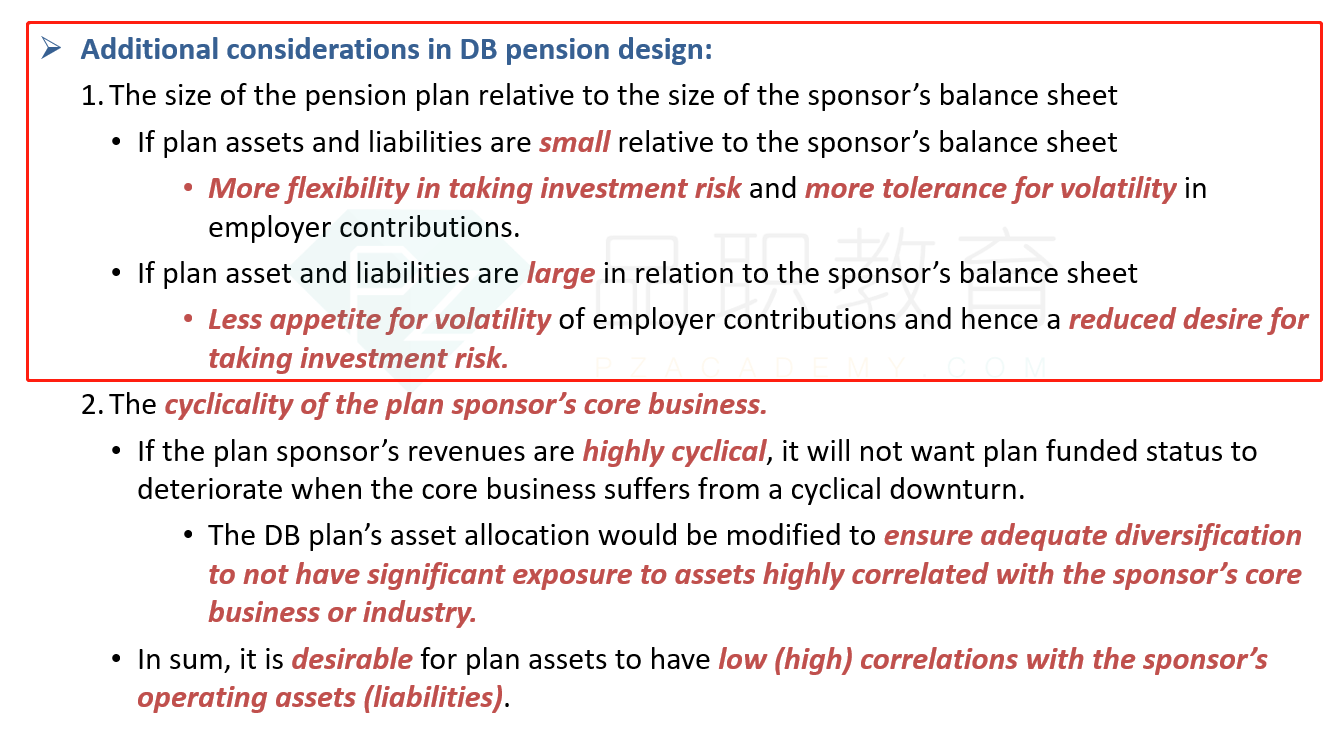

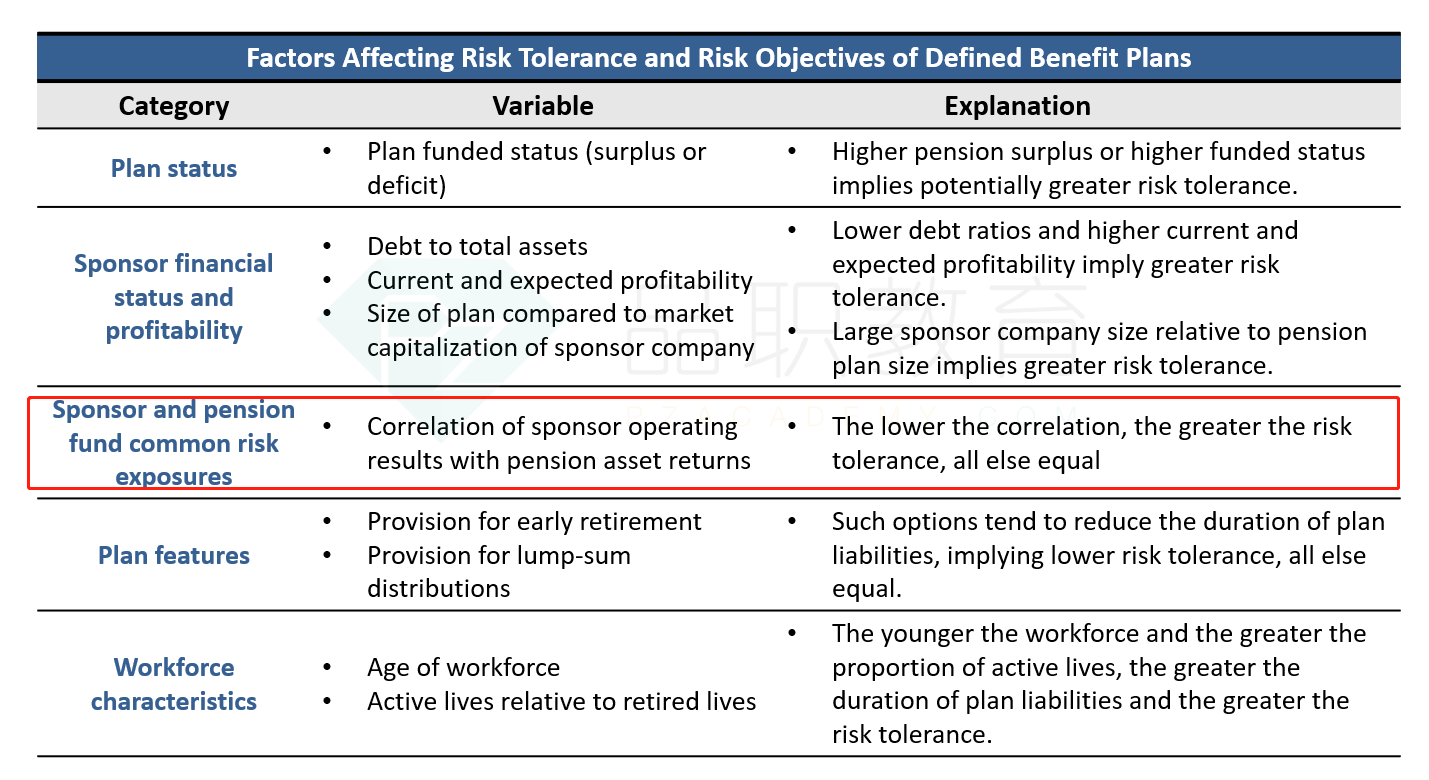

老师,您好!请问题干中“Azarov also explains that Maglav’s operating results have a low correlation with pension asset returns and that the investment strategy is affected by the fact that the pension fund assets are a small portion of Maglav’s market capitalization. ”这段话的是有用信息么?具体什么含义,没大看明白,谢谢