问题如下:

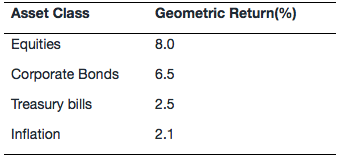

An analyst observes the following historic geometric returns:

The real rate of return for corporate bonds is closest to:

选项:

A. 4.3%.

B. 4.4%.

C. 4.5%.

解释:

A is correct.

(1 + 0.065)/(1 + 0.0210)-1 = 4.3%

这个公式是哪里讲的??

NO.PZ2015121801000046问题如下 analyst observes the following historic geometric returns:The rerate of return for corporate bon is closest to:A.4.3%.B.4.4%.C.4.5%. is correct.(1 + 0.065)/(1 + 0.0210)-1 = 4.3%公式1+名义收益率=(1+通货膨胀率)(1+实际收益率) 这道题问的是实际收益率,但是答案里用算名义收益率的方法计算了实际收益率,是不是写错了?

NO.PZ2015121801000046 问题如下 analyst observes the following historic geometric returns:The rerate of return for corporate bon is closest to: A.4.3%. B.4.4%. C.4.5%. is correct.(1 + 0.065)/(1 + 0.0210)-1 = 4.3%公式1+名义收益率=(1+通货膨胀率)(1+实际收益率) 题目是不是有问题?之前有个条件一样的题目,让算corporate bonrisk premium,给的答案是用6.5/2.5,那么不是说明这个6.5里是还包含了risk premium的吗?所以最后应该是rerate=6.5/(6.5/2.5)/2.1=1.2??

NO.PZ2015121801000046 问题如下 analyst observes the following historic geometric returns:The rerate of return for corporate bon is closest to: A.4.3%. B.4.4%. C.4.5%. is correct.(1 + 0.065)/(1 + 0.0210)-1 = 4.3%公式1+名义收益率=(1+通货膨胀率)(1+实际收益率) 如题目

NO.PZ2015121801000046问题如下 analyst observes the following historic geometric returns:The rerate of return for corporate bon is closest to:A.4.3%.B.4.4%.C.4.5%. is correct.(1 + 0.065)/(1 + 0.0210)-1 = 4.3%公式1+名义收益率=(1+通货膨胀率)(1+实际收益率) 可以详细讲解一下解题思路吗?谢谢老师

NO.PZ2015121801000046 问题如下 analyst observes the following historic geometric returns:The rerate of return for corporate bon is closest to: A.4.3%. B.4.4%. C.4.5%. is correct.(1 + 0.065)/(1 + 0.0210)-1 = 4.3% 这道题为什么不用先算risk premium呢?