问题如下:

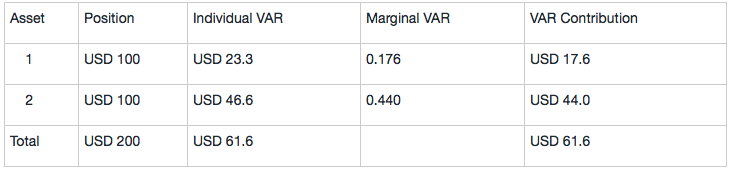

A risk manager assumes that the joint distribution of returns is multivariate normal and calculates the following risk measures for a two-asset portfolio:

If asset 2 is dropped from the portfolio, what is the reduction in portfolio VAR?

选项:

A.USD 15.0

B.USD 38.3

C.USD 44.0

D.USD 46.6

解释:

B is correct. This is 61.6 minus the portfolio VAR of asset 1 alone, which is USD 23.3, for a difference of 38.3.

既然CVAR加总是组合的VAR。为啥拿走资产2,所降低的不是考虑diversification之后资产2的CVAR