问题如下:

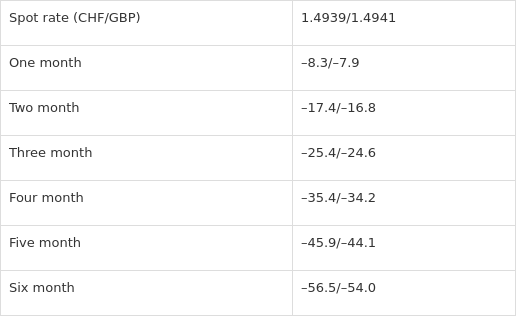

Six months ago, a dealer sold CHF 1 million forwardagainst the GBP for a 180-dayterm at an all-in rate of 1.4850 (CHF/GBP). Today,the dealer wants to roll this positionforward for another six months (i.e., thedealer will use an FX swap to roll the positionforward).The following are thecurrent spot rate and forward points being quoted for theCHF/GBP currency pair:

The cash flow that the dealer will realize onthe settlement date is closest to an:

选项:

A. inflowof GBP 4,057

B. inflowof GBP 8,100

C. outflowof GBP 5,422

解释:

180days ago, the dealer sold 1 million CHF against the GBP for1.4850. Today, thedealer will have to buy CHF 1 million to settle the maturing forwardcontract,so the CHF amounts will net to zero on settlement day. Because these CHFamountsnet to zero, the cash flow on settlement day is measured in GBP. The GBPamountis calculated as follows: 180 days ago, the dealer sold CHF 1 million againsttheGBP at a rate of 1.4850, which is equivalent to buying GBP673,400.67(1,000,000/1.4850). That is, based on the forward contract, thedealer will receive GBP673,400.67 on settlement day. Today, the dealer isbuying CHF 1 million at a spot rateof 1.4940 (the mid-market spot rate, becausethis is an FX swap). This transaction isequivalent to selling GBP 669,344.04(1,000,000/1.4940). That is, based on the spottransaction, the dealer will payout GBP 669,344.04 on settlement day. Combining thesetwo legs of the swaptransaction, we have:

(1,000,000/1.4850)-(1,000,000/1.4940) = GBP 4,056.63

解析:180天前,该交易商以1英镑兑1.4850瑞郎的价格卖出了100万瑞郎。那么现在,经销商必须购买100万瑞士法郎来结算到期的远期合约,那么结算日的瑞士法郎净额将为零。由于这些瑞士法郎的净值为零,所以结算日的现金流以英镑计算。英镑金额计算如下:180天前,经销商以1.4850的汇率卖出100万瑞郎兑1英镑,相当于买入673,400.67英镑(100万/1.4850)。也就是说,根据远期合同,经销商在结算日收到GBP 673,400.67。今天,该交易商以1.4940瑞郎的即期利率(中间市场即期利率,因为这是一种外汇互换)买入100万瑞郎。这笔交易相当于卖出669,344.04英镑(100亿英镑/1.4940英镑)。也就是说,基于现货交易,该交易商将在结算日支付669,344.04英镑。清算这两部分,可以得到:

(1000000/1.4850)-(1000000/1.4940)=4056 .63英镑

先问2个语言问题: 1 第一句话是说六个月前他以1.485卖了1m的chf,并在180天后要再买回来1m的chf。但我理解成了6个月前他有一个远期合约,要在6个月后以1.485卖chf。。。我的这种理解用英语是咋表达的?题目用了sold这个动词,而不是would sell,区别在这是不? 2 第二句话他想再延期6个月,那结束日期为什么不是再过6个月后的日子? 另外第三个问题,按题目解释,6个月前买入673400英镑 现在时点卖出669344英镑,就应该是流出4056多英镑,为什么答案是inflow?