问题如下:

Among the carry trades available in the US, Euro, and UK markets, the highest expected return for the USD-denominated portfolio over the next 6 months is closest to:

选项:

A.0.275%.

B.0.85%.

C.0.90%.

解释:

B is correct.

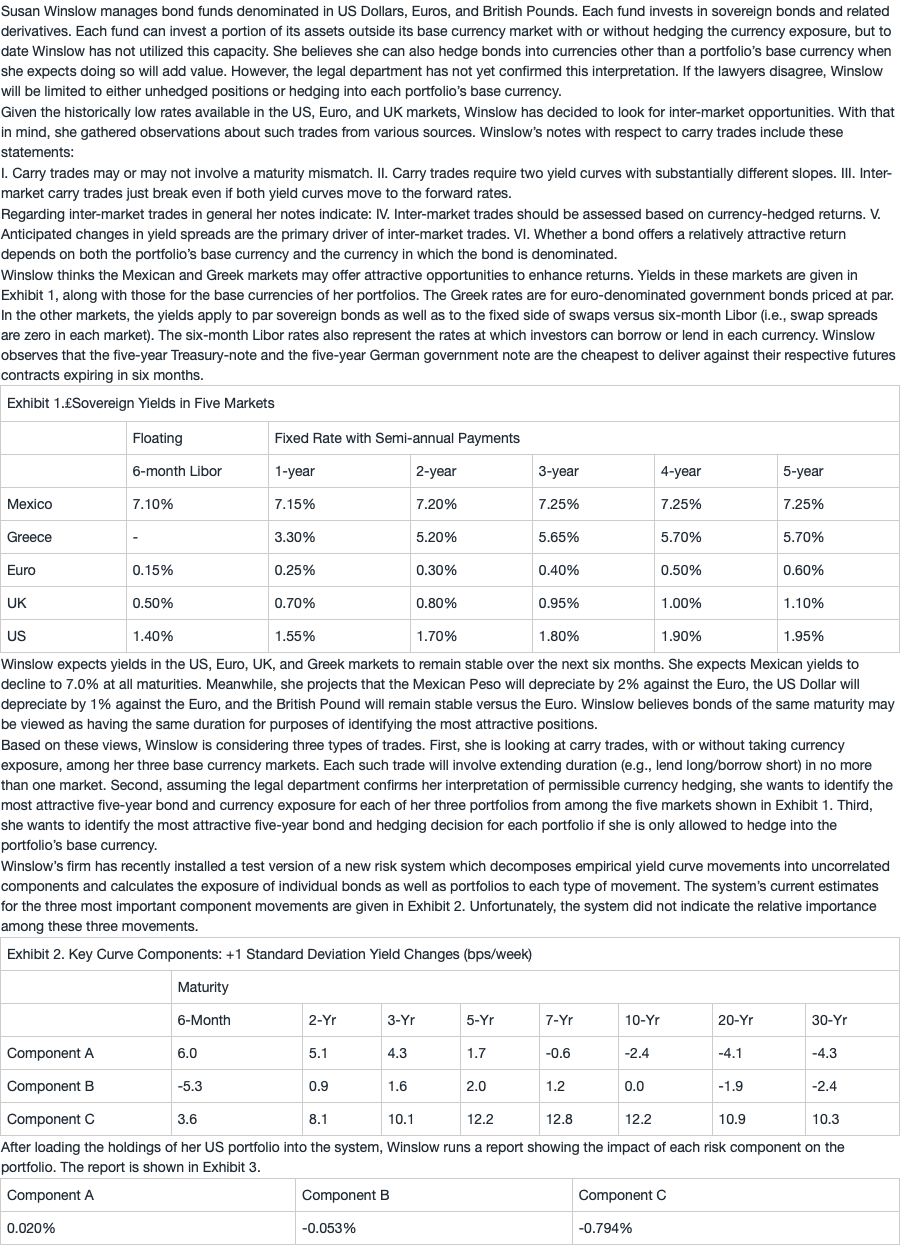

The highest potential return, 0.85%, reflects borrowing USD for 6 months and buying the UK 5-year bond. The carry component of the expected return is actually a loss of 0.15% [= (1.10% – 1.40%)/2], but this is more than offset by the 1% expected appreciation of GBP versus USD. A much higher carry component +0.90% = (1.95% – 0.15%)/2 could be obtained by borrowing for 6 months in EUR to buy the US 5-year note, but that advantage would be more than offset by the expected 1% loss from depreciation of the USD (long) against the Euro (short).

A is incorrect because a higher expected return of 0.85% can be obtained. This answer, +0.275% [= (1.95% – 1.40%)/2], is the highest carry available over the next 6 months within the US market itself (an intra-market carry trade).

C is incorrect. This answer (+0.90%) is the highest potential carry component of return but ignores the impact of currency exposure (being long the depreciating USD and short the appreciating Euro).

appreciation为什么不除以二呢?