问题如下:

Which of the following about bond's tax consideration is least appropriate?

选项:

A.Interest income paid to bondholders is usually taxed as ordinary income.

B.Municipal bonds are usually tax-exempt.

C.The original issue discount tax provision requires the investors to pay tax on capital gain at maturity.

解释:

C is correct.

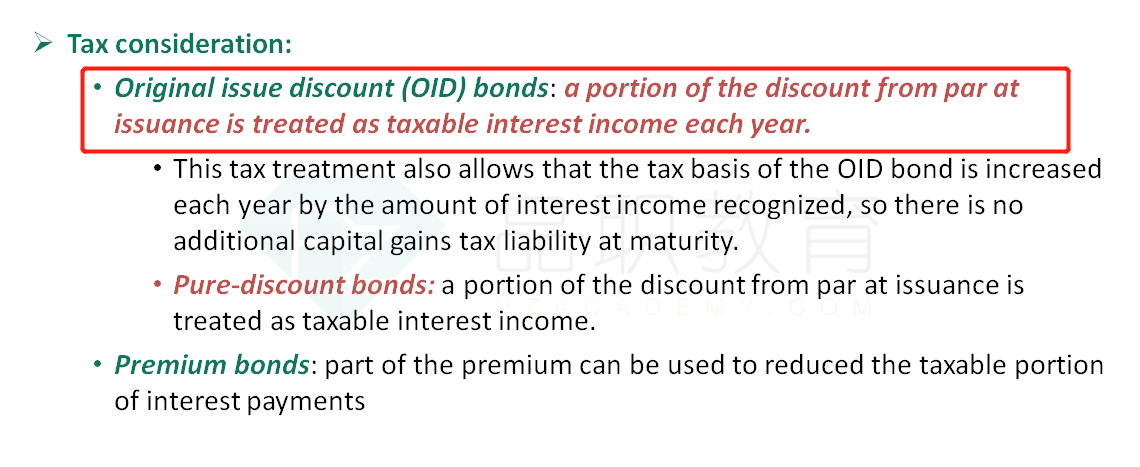

The original issue discount tax provision requires the investor to include a prorated portion of the original issue discount in his taxable income every tax year until maturity. Thus, the cost basis in the bond is increased each year, and when the bond matures, there is no capital gain or loss.

For exampe, a 10-year zero coupon bond is issued at 600, and the par value is 1000. The original issue discount is: 1000 - 600 = 400; With original issue discount tax provision, as the bond's matruity is 10 years, the prorated portion included in the investors' taxable income each year is: 400/10 = 40. The cost basis for the first year is 600, after the first tax year, the cost basis is increased to 640. The original issue discount tax provision allows investor to increase his cost basis in the bond gradually so that when the bond matures, he faces no capital gain or loss.

能解答一下C选项吗,谢谢