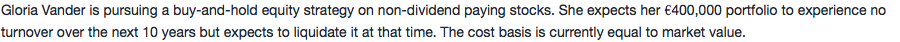

问题如下:

1. If Vander expects an 8 percent pretax return and capital gains are taxed at 20 percent, what is her accrual equivalent return over that time period?

选项:

A.6.40%.

B.6.78%.

C.4.60%.

解释:

B is correct.

FVcg =€400,000[(1 + r)n(1–tcg) + tcg]

=€400,000[(1 + 0.08)10(1–0.20) + 0.20]

=€770,856

Solving for the rate set equates €770,856 with its present value of €400,000

€770,856 =€400,000(1 + RAE)10

RAE = 0.0678 or 6.78 percent

老师您好,请问如何从题干中得出这道题目应该用deferred capital gain的公式计算?

我在做题过程中,没有看到deferred,于是就按照每年都交cg tax来处理了。。

非常感谢^_^!!