问题如下:

Abram and Edgarton recently attended an investment committee meeting where interest rate expectations for the next 12 months were discussed. The Fund’s mandate allows its duration to fluctuate ±0.30 per year from the benchmark duration. The Fund’s duration is currently equal to its benchmark. Although the Fund is presently invested entirely in annual coupon

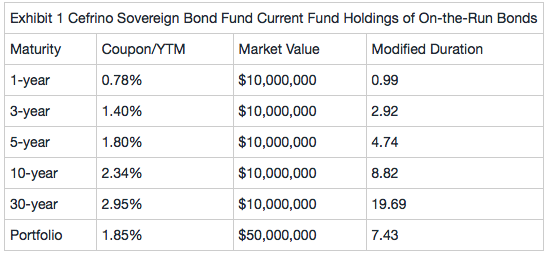

sovereign bonds, its investment policy also allows investments in mortgage-backed securities (MBS) and call options on government bond futures. The Fund’s current holdings of on-the-run bonds are presented in Exhibit 1

Over the next 12 months, Abram expects a stable yield curve; however, Edgarton expects a steepening yield curve, with short-term yields rising by 1.00% and long-term yields rising by more than 1.00%.

Based on her yield curve forecast, Abram recommends to her supervisor changes to the Fund’s holdings using the following three strategies:

Strategy 1: Sell the 3-year bonds, and use the proceeds to buy 10-year bonds.

Strategy 2: Sell the 5-year bonds, and use the proceeds to buy 30-year MBS with an effective duration of 4.75.

Strategy 3: Sell the 10-year bonds, and buy call options on 10-year government bond futures.

Based on Exhibit 1 and Abram’s interest rate expectations, which of the following strategies is expected to perform best over the next 12 months?

选项:

A.Strategy 1

Strategy 2

Strategy 3

解释:

B is correct.

In a stable yield curve environment, holding bonds with higher convexity negatively affects portfolio performance. These bonds have lower yields than bonds with lower convexity, all else being equal. The 5-year US Treasury has higher convexity than the negative convexity 30-year MBS bond. So, by selling the 5-year Treasury and purchasing the 30-year MBS, Abram will reduce the portfolio’s convexity and enhance its yield without violating the duration mandate versus the benchmark.

老师:请问 B选项和C选项的区别是什么呢?