问题如下:

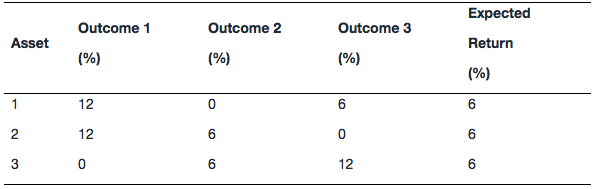

An analyst has made the following return projections for each of three possible outcomes with an equal likelihood of occurrence:

If the analyst constructs two-asset portfolios that are equally-weighted, which pair of assets has the lowest expected standard deviation?

选项:

A.Asset 1 and Asset 2.

B.Asset 1 and Asset 3.

C.Asset 2 and Asset 3.

解释:

C is correct.

An equally weighted portfolio of Asset 2 and Asset 3 will have the lowest portfolio standard deviation, because for each outcome, the portfolio has the same expected return (they are perfectly negatively correlated).

完全负相关可得出该组合有最低的标准差,计算机是不是也可以算出标准差,为啥我1&2,2&3算出来的标准差是一样的,能否麻烦把1&2, 2&3,1&3的计算器步骤都写出来,然后比较标准差