问题如下:

The portfolio strategy implemented by McLaughlin last year is mostly likely to be described as:

选项:

A.a carry trade.

B.a barbell structure.

C.riding the yield curve.

解释:

C is correct.

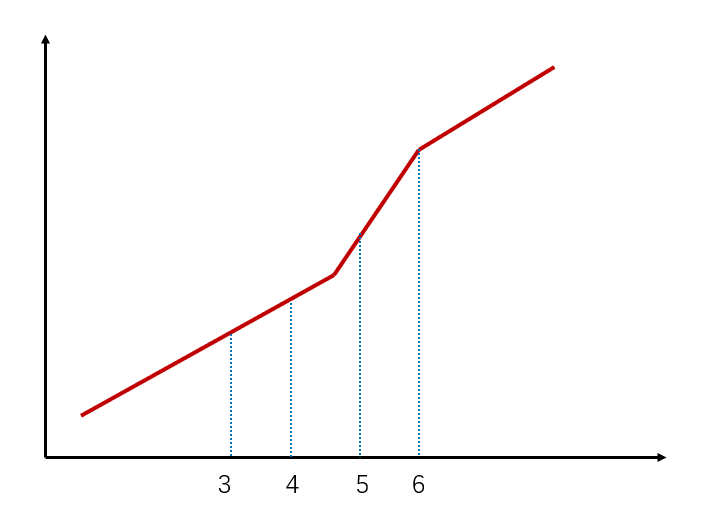

Last year, McLaughlin expected the yield curve to be stable over the year. Riding the yield curve is a strategy based on the premise that, as a bond ages, it will decline in yield if the yield curve is upward sloping. This is known as "roll down"; that is, the bond rolls down the (static) curve. Riding the yield curve differs from buy and hold in that the manager is expecting to add to returns by selling the security at a lower yield at the horizon. This strategy may be particularly effective if the portfolio manager targets portions of the yield curve that are relatively steep and where price appreciation resulting from the bond’s migration to maturity can be significant. McLaughlin elected to position her portfolio solely in 20-year Treasury bonds, which reflect the steepest part of the yield curve, with the expectation of selling the bonds in one year.

老师好,最有一句话中的McLaughlin elected to position her portfolio solely in 20-year Treasury bonds, which reflect the steepest part of the yield curve, with the expectation of selling the bonds in one year. 如何 reflect the steepest part of the yield curve 的呢?如何理解?