问题如下:

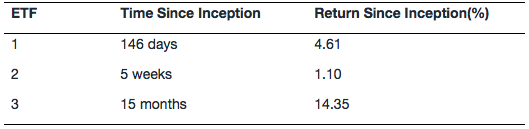

An investor evaluating the returns of three recently formed exchange-traded funds gathers the following information:

The ETF with the highest annualized rate of return is:

选项:

A.ETF 1.

B.ETF 2.

C.ETF 3.

解释:

B is correct.

The annualized rate of return for ETF 2 is 12.05% = (1.0110 )-1, which is greater than the annualized rate of ETF 1, 11.93% = (1.0461 )-1, and ETF 3, 11.32% = (1.1435 )-1. Despite having the lowest value for the periodic rate, ETF 2 has the highest annualized rate of return because of the reinvestment rate assumption and the compounding of the periodic rate.

在课件中,讲到HPR时,老师举例子,对6个月的HPR年化时采用R=HPR*360/t,对于超过一年的HPR年化时采用复利模式

本题中,说的是RETURN,应该是HPR,为什么解析对于一年以内的也采用了复利计算呢?

Thanks♪(・ω・)ノ