问题如下:

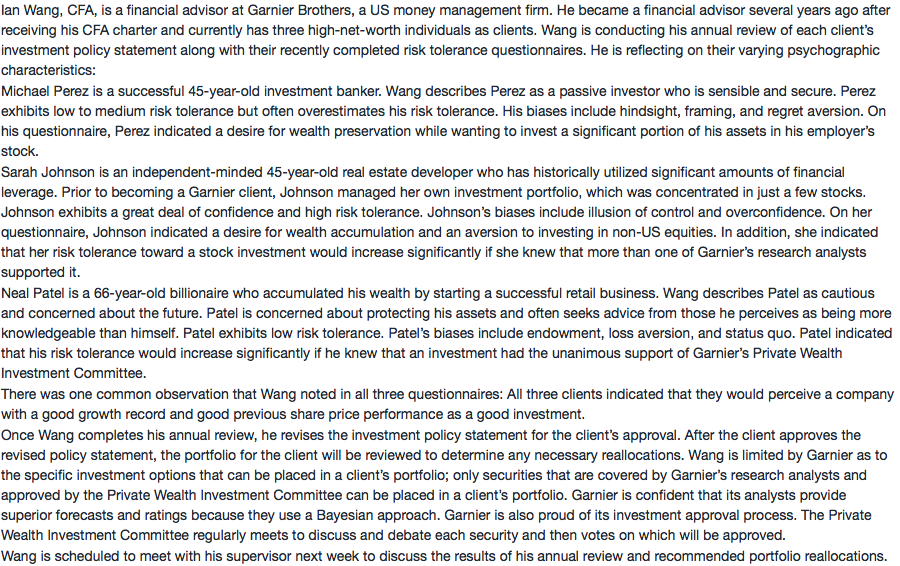

Which of the following behavioral biases would be most relevant in constructing a portfolio for Johnson?

选项:

A.Home bias.

B.Overconfidence.

C.Inertia and default.

解释:

A is correct.

Home bias is evident in Johnson’s questionnaire. Johnson has expressed an aversion to investing in non-US equities. Familiarity with their country may lead investors to own high concentrations of domestic assets and ignore the benefits of international diversification.

老师,这道题目做对了,但是想请教下相关的知识点。谢谢