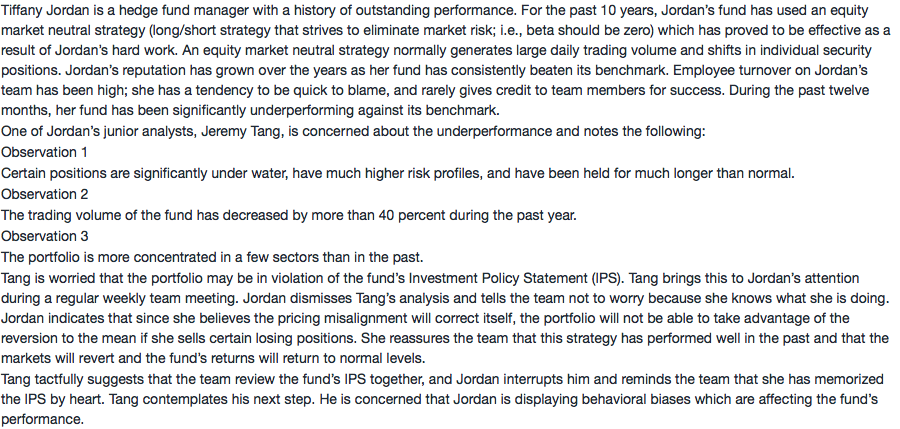

问题如下:

How does Jordan most likely demonstrate loss-aversion bias?

选项:

A.Telling the team not to worry.

B.Reducing the portfolio turnover this year.

C.Deciding to hold the losing positions until they turn around.

解释:

C is correct.

Jordan’s behavior is a classic example of loss aversion: When a loss occurs, she holds on to these positions longer than warranted. By doing so, Jordan has accepted more risk in the portfolio. Loss-aversion bias is one in which people exhibit a strong preference to avoid losses versus achieving gains. One of the consequences of loss aversion bias is that the financial management professional (in this case, Jordan) may hold losing investments in the hope that they will return to break-even or better.

对于B选项,助教老师说“改为during past year”就对了,想请问,这道题目是这样的幼稚题点吗?不对吧?

如果我站在一年的年底,那么按照case文中第一段的“during the past 12 months”,不就是“during this year”,不就是B选项的描述吗?那么B就是正确的了啊?????