问题如下:

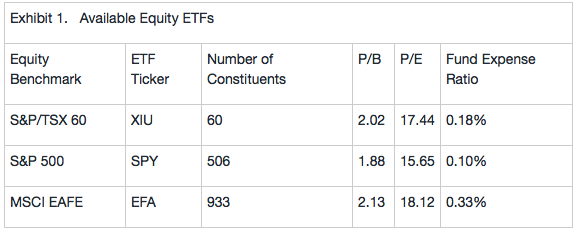

Winthrop and Tong agree

that only the existing equity investments need to be liquidated. Tong suggests

that, as an alternative to direct equity investments, the new equity portfolio

be composed of the exchange-traded funds (ETFs) shown in Exhibit 1.

Based

on Exhibit 1 and assuming a full-replication indexing approach, the tracking

error is expected to be highest for:

选项:

A.XIU

SPY

EFA

解释:

An index that contains a large number of constituents will tend to

create higher tracking error than one with fewer constituents. Based on the

number of constituents in the three indexes (S&P/TSX 60 has 60, S&P 500

has 506, and MSCI EAFE has 933), EFA (the MSCI EAFE ETF) is expected to have

the highest tracking error. Higher expense ratios (XIU: 0.18%; SPY: 0.10%; and EFA:

0.33%) also contribute to lower excess returns and higher tracking error, which

implies that EFA has the highest expected tracking error.

从expense的角度可以理解,从个数的角度,怎么看C总体有多少个股票?从而怎么影响TE?A、B题目中可以看出全部复制是多少个股票。