问题如下:

Company M, a pharmaceutical corporation, is going to expand its market to a foreign country. The company is in the 25% tax bracket. Matt, CFA, is evaluating the expansion project and collecting relevant information in the following exhibit. What’s the weighted average cost of capital for Company M?

选项:

A.13.125%

B.12.75%

C.13.5%

解释:

B is correct.

考点:Risk Analysis

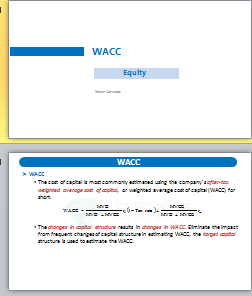

解析:根据公式WACC = wd*rd*(1-T)+we*re,其中wd和we是以市场价值为权重而非账面价值。

WACC = 30%*10%*(1-25%)+70%*15% = 12.75%

这个概念是在equity里面讲的吗?