问题如下:

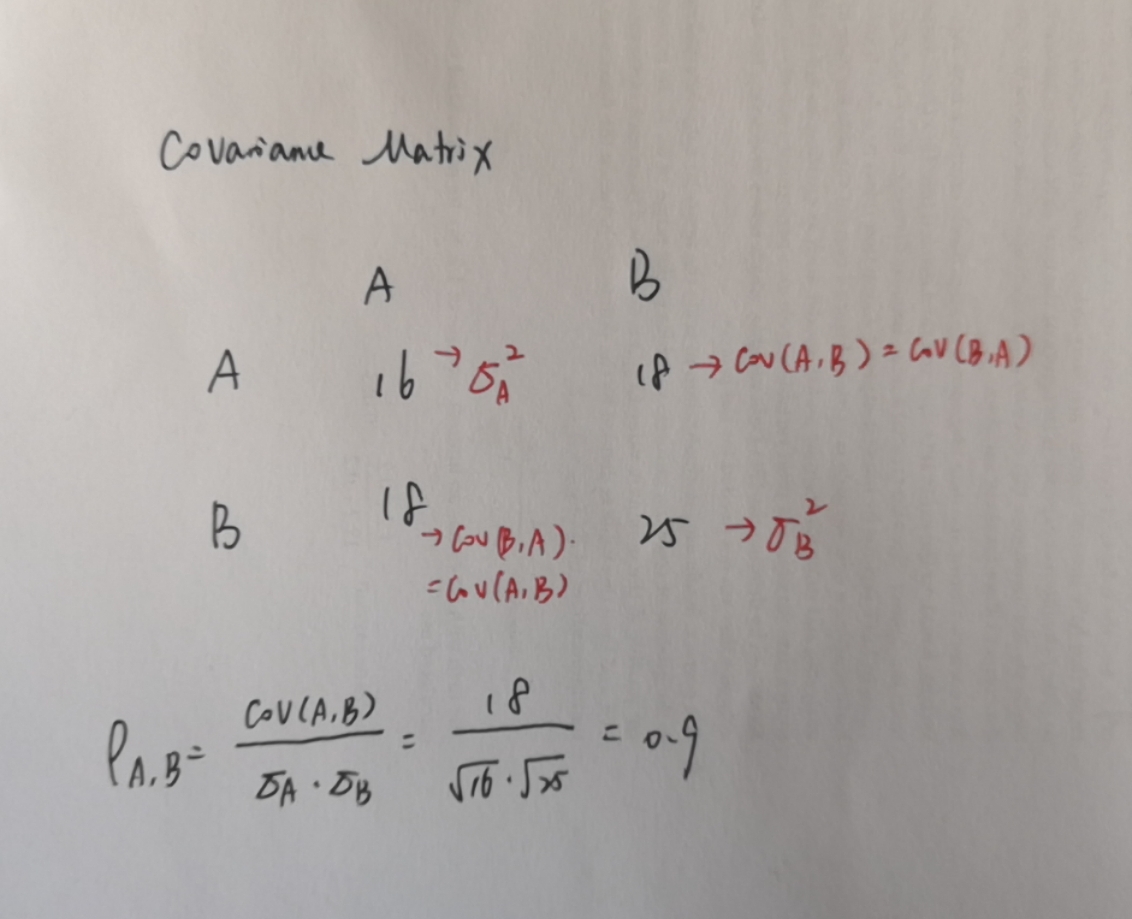

Given the covariance matrix above, the correlation of returns between portfolio A and portfolio B is closest to:

选项:

A.0.045.

B.0.1.

C.0.9.

解释:

C is correct. ρ(RA,RB) = Cov(RA,RB)/σ(RA) σ(RB) =18/(160.5 × 250.5) =18/(4×5) =0.9

老师好,这道题目知道运用公式correlation=cov(x,y)/S.Dx S.Dy 但是根据公式套入数字的时候不知道该怎么算了。能麻烦老师解释一下吗,最好有过程谢谢老师。