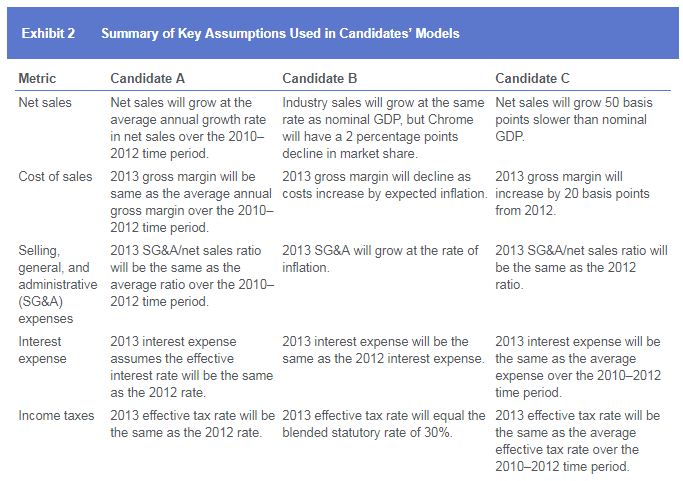

Q. Based on Exhibit 2, forecasted interest expense will reflect changes in Chrome’s debt level under the forecast assumptions used by:

- Candidate A.

- Candidate B.

- Candidate C.

Solution

A is correct. In forecasting financing costs such as interest expense, the debt/equity structure of a company is a key determinant. Accordingly, a method that recognizes the relationship between the income statement account (interest expense) and the balance sheet account (debt) would be a preferable method for forecasting interest expense when compared with methods that forecast based solely on the income statement account. By using the effective interest rate (interest expense divided by average gross debt), Candidate A is taking the debt/equity structure into account whereas Candidate B (who forecasts 2013 interest expense to be the same as 2012 interest expense) and Candidate C (who forecasts 2013 interest expense to be the same as the 2010–2012 average interest expense) are not taking the balance sheet into consideration.

为什么根据A的说法就可以通过利息费用看出这个公司的债务水平发生变化了呢?答案没看懂。请老师解释下,考了effetive interest rate仅从这一点就可以判断出吗?不能理解