Before making recommendations, Kim and Lin discuss the comparability of a number of metrics they have compiled for South African stocks with stocks Lin has identified in Canada through separate analysis.

“In regard to estimating the required rate of return for the South African and Canadian equity markets,” Kim says, “I believe the most important adjustments will be:

- accounting for differences in GDP growth rates,

- incorporating exchange rate forecasts into the calculations, and

- including a country premium for stocks in South Africa.”

- the country premium.

- exchange rate forecasts.

- GDP growth rates.

Q. Which of Kim’s suggested adjustments when comparing the required rates of return for South African and Canadian stocks is least relevant? The adjustment related to:

Solution

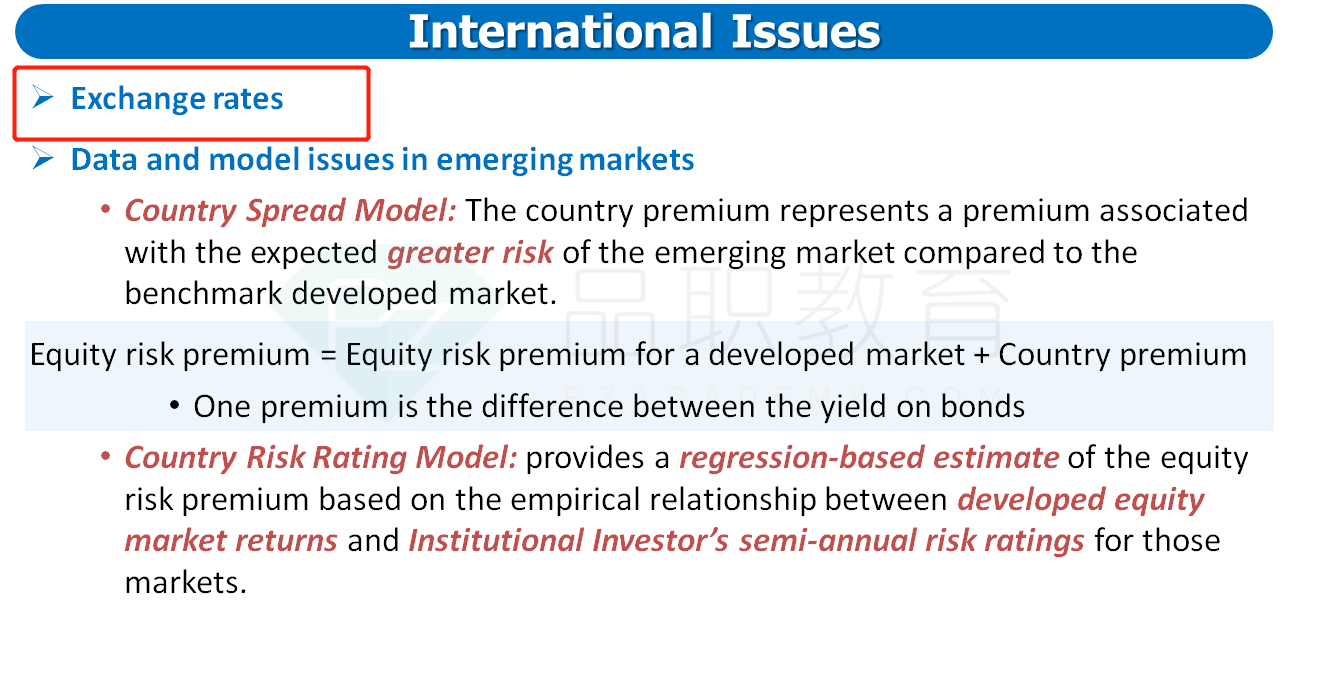

C is correct. Differences in GDP growth rates between countries may exist, but this is not an important consideration specific to estimating required rate of return between the two countries. Both exchange rates and model issues in emerging markets are important considerations that concern analysts estimating required returns in a global context.

A is incorrect because investing in emerging markets such as South Africa is typically associated with greater expected risk, and analysts may want to consider incorporating a country spread model or a country risk rating model.

B is incorrect because equity risk premium estimates in home currency terms can be higher or lower than estimates in local currency terms.