问题如下:

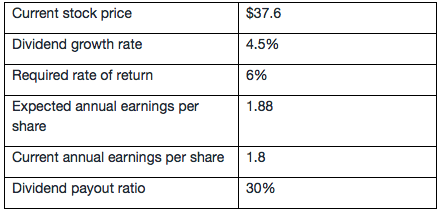

Matt wants to use the Gordon growth model to find a justified leading P/E for the Company M. He has assembled the information in the given table.

Based on the justified leading P/E and the actual leadingP/E, determine whether the stock is fairly valued, overvalued, or undervalued?

选项:

A.Overvalued.

B.Fairly valued.

C.Undervalued.

解释:

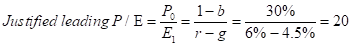

B is correct.

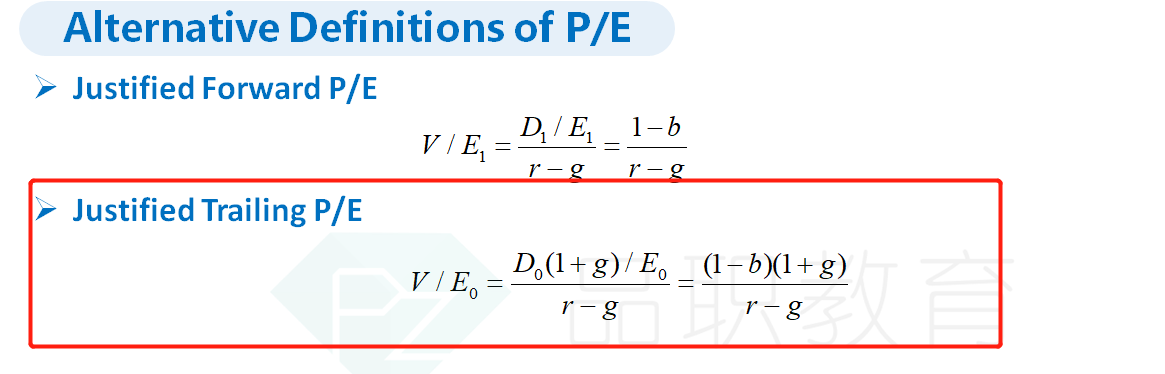

考点:Gordon Growth Model

解析:

Actual leading P/E = 37.6/1.88 = 20

两者相等,所以股票被正确定价。

老师,您好,请问这里的justified leading P/E不能用30%(1+g)/(re-g)?