问题如下:

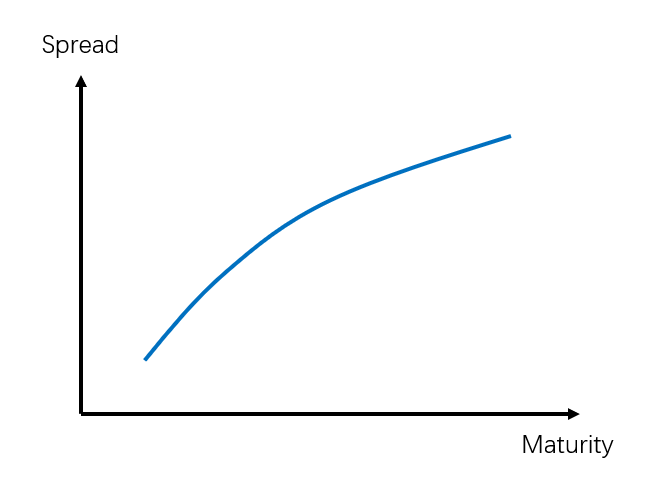

Petit develops investment recommendations for a currency-hedged portfolio of US and European corporate bonds. She expects US interest rates to decline relative to European interest rates. Furthermore, the spread curve for US corporate bonds indicates that the average spread of five-year BB bonds exceeds the average spread of two-year BB bonds by +90 bps. Petit expects the difference between average credit spreads for these two sectors to narrow to +50 bps.

Based on Petit’s expectations for US and European corporate bonds, which of the following positions relative to the portfolio’s benchmark should she recommend?

选项:

解释:

B is correct.

Petit should recommend markets in which yields are expected to decline relative to other markets. As a result, Petit should recommend overweighting US bonds relative to European bonds and overweighting US five-year BB bonds relative to US two-year BB bonds.

为什么5年的spread高于2年的还要overweight?