问题如下:

Matt is preparing to evaluate Company M `s intrinsic value. If he uses net income as a proxy for Company M’s FCFE, the intrinsic value would be:

选项:

A.higher

B.the same

C.lower

解释:

A is correct.

考点:Proxy for FCF

解析:从NI出发计算FCFE:FCFE = NI + NCC – WCInv – FCInv + Net Borrowing

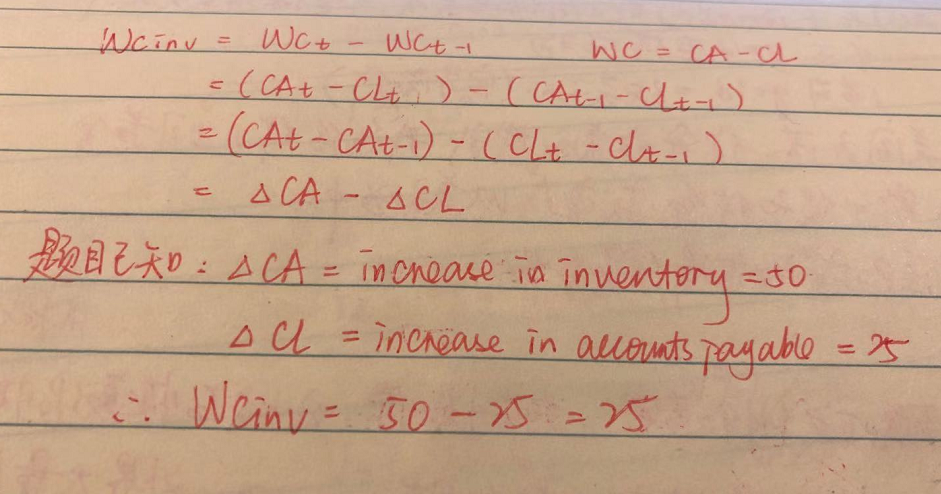

WCInv = Increase in inventories – increase in accounts payable = 50-25 = $25 million

NB = Increase in notes payable - decrease in long-term debt = 60-50 = $10 million

FCFE = 212 + 88 – 25 – 100 +10 = $185 million

所以用NI代替FCFE估值,内在价值会更高。

老师好,为什么这题不是WCInv = -Increase in inventories + increase in accounts payable , increast in inventory 说明我在投资,投资是现金流 流出于是减去increase in inventories 然后increase in A/ P 说明我在融资, 融资是现金流流入于是+increase in A/ P 。 WCInv = -50+25 = 25 . 然后带入FCFE = NI +Dep -WCinv -FCinv +NB= 212+88-(-25)-100+10 = 235 , FCFE = 235 > 212 所以是如果用NI 会lower than using FCFE? 我现金流这里的理解哪里有错? 谢谢。