问题如下:

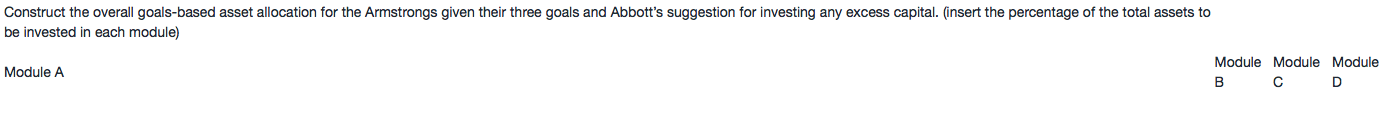

Construct the overall goals-based asset allocation for the Armstrongs given their three goals and Abbott’s suggestion for investing any excess capital. Show your calculations.

Show your calculations.

选项:

解释:

Guideline Answer:

■ The module that should be selected for each goal is the one that offers the highest return given the time horizon and required probability of success.

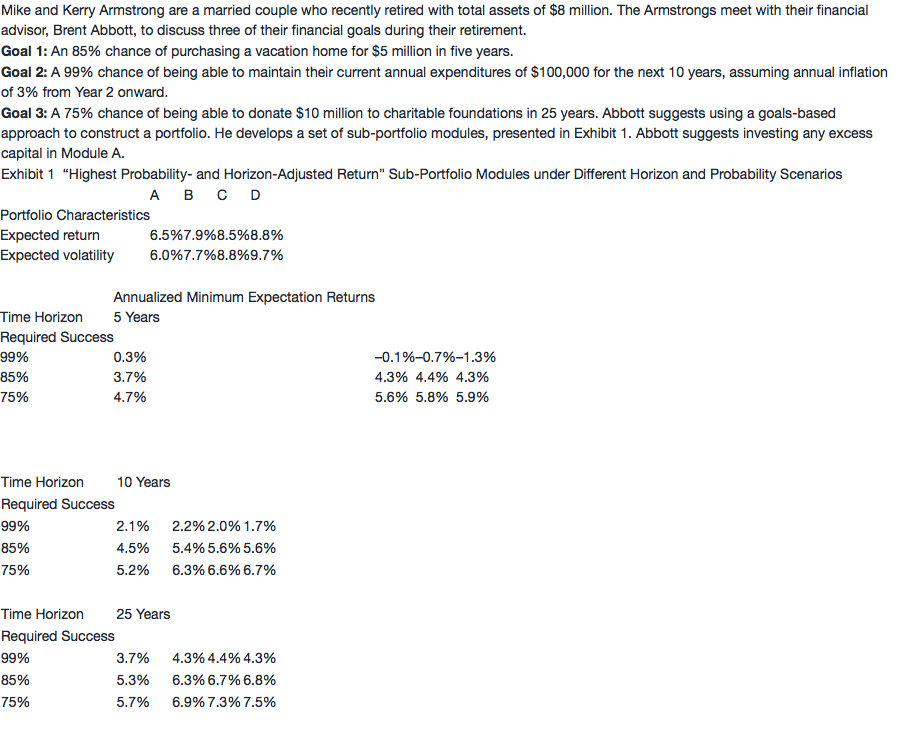

■ Approximately 16.4%, 12.7%, 50.4%, and 20.5% should be invested in Modules A, B, C, and D, respectively. The appropriate goals-based allocation for the Armstrongs is as follows:

Supporting calculations:

For Goal 1, which has a time horizon of five years and a required probability of success of 85%, Module C should be chosen because its 4.4% expected return is higher than the expected returns of all the other modules. The present value of Goal 1 is calculated as follows:

N = 5, PV = –5,000,000, I/Y = 4.4%; CPT PV = $4,031,508 (or $4.03 million)

So, approximately 50.4% of the total assets of $8 million (= $4.03 million/$8.00 million) should be allocated to Module C.

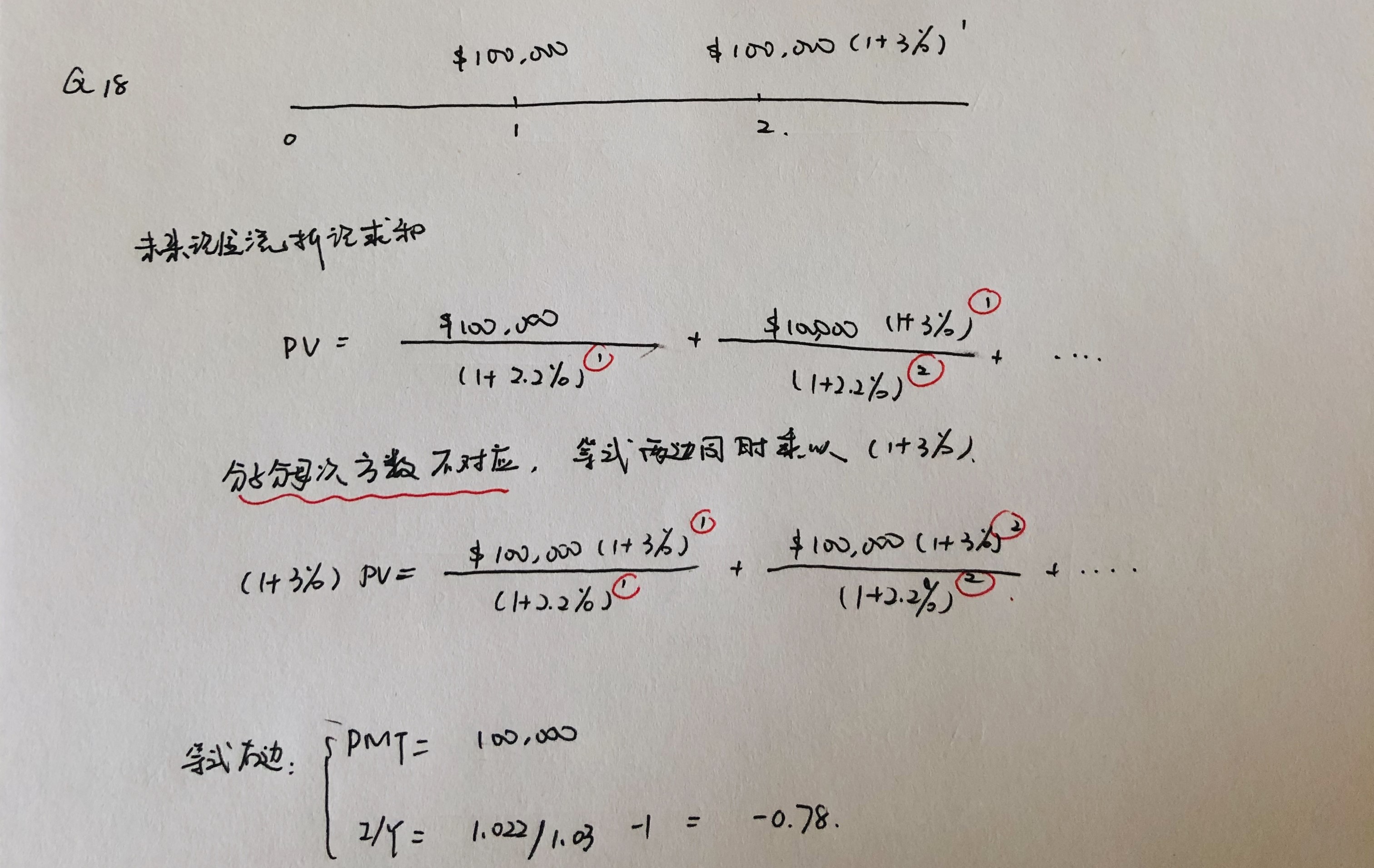

For Goal 2, which has a time horizon of 10 years and a required probability of success of 99%, Module B should be chosen because its 2.2% expected return is higher than the expected returns of all the other modules. The present value of Goal 2 is calculated as follows:

PV=$100,000/(1.022)1+$100,000(1.03)1/(1.022)2+$100,000(1.03)2/(1.022)3+...+$100,000(1.03)9/(1.022)10

PV = $1,013,670 (or $1.01 million)

So, approximately 12.7% of the total assets of $8 million (= $1.01 million/$8.00 million) should be allocated to Module B.

For Goal 3, which has a time horizon of 25 years and a required probability of success of 75%, Module D should be chosen because its 7.5% expected return is higher than the expected returns of all the other modules. The present value of

Goal 3 is calculated as follows:

N = 25, PV = –10,000,000, I/Y = 7.5%; CPT PV = $1,639,791 (or $1.64 million)

So, approximately 20.5% of the total assets of $8 million (= $1.64 million/$8.00 million) should be allocated to Module D.

Finally, the surplus of $1,315,032 (= $8,000,000 – $4,031,508 – $1,013,670 –$1,639,791), representing 16.4% (= $1.32 million/$8.00 million), should be invested in Module A following Abbott’s suggestion.

这题我有两个问题

- 我记得基础课说discount rate 应该是用mathematical expected return折,不然这里给的expected return 用意在哪里?什么时候用得到呢?

- 算goal 2 的时候,我记得何老师说可以不调PMT,调折现率是一样的,(1+r)(1+3%inflation)=1+nominal 折现率

这里为什么不能那么做呢?这样考试的时候就会很节约时间