问题如下:

John C. Hill, sole owner of JCH Equipment Leasing Co. (JCH), is evaluating a future sale of his company and approaches Mary Keller, a wealth adviser, for advice.

Hill refers his friend, Richard Morrison, the former CEO of Masury Bridge and Iron (MBI), to Keller to discuss his wealth goals. Keller meets with Morrison and gathers the following information:

• Richard Morrison is 50 years old and his spouse, Meredith, is 49 years old. Both are healthy and both expect to live at least an additional 40 years.

• The Morrisons have a 20-year-old son and would like to transfer 5% of their wealth to him during their lifetime.

• Richard Morrison retired two years ago and intends to spend his time serving on philanthropic boards; Meredith does not work.

• The Morrisons own 2 million shares of MBI, currently valued at $50 million, representing approximately 90% of their wealth.

• MBI is a large, publicly traded company, and the Morrisons’ position equals approximately 1% of the total market capitalization.

• The Morrison family depends on dividends from MBI for their day-to-day living expenses.

• The cost basis of their MBI shares is close to zero, and the capital gains tax rate is 15%.

• Richard Morrison is loyal to MBI, follows the stock closely, believes he knows the company better than other investors, and expects the company to continue to be a good investment in the future just like it has been in the past.

• The Morrisons’ key objective is to maintain their current standard of living during retirement.

Explain three emotional biases that may affect Richard Morrison’s decision making.

选项:

解释:

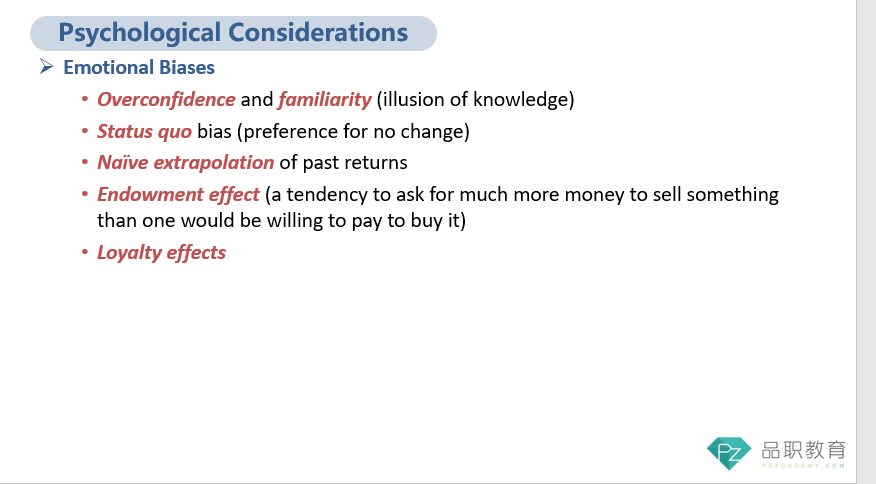

A number of emotional biases can negatively affect the decision-making of holders of concentrated positions. Specifically, Richard Morrison’s decision to diversify may be negatively affected by loyalty effects, overconfidence/familiarity, and status quo/naïve extrapolation of past returns. The facts indicate that Mr. Morrison is extremely loyal to MBI (loyalty effect); he believes he knows the company better than other investors (overconfidence/familiarity); and he expects the company to continue to be a good investment as it has been in the past (status quo/naïve extrapolation of past returns).

1)请问为何此题有naïve extrapolation呢?这个不是应该在DC plan中的吗?2)此题为何没有halo effect and representativeness bias呢?谢谢。