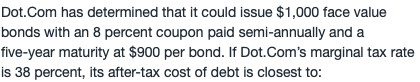

问题如下图:

选项:

A.

B.

C.

解释:

企鹅_品职助教 · 2019年11月12日

嗨,爱思考的PZer你好

如果债券是以par value发行,也就是债券的PV和FV都是1000, 那么像你说的这样直接用8%作为债券成本是可以的。但是当债券折价或溢价发行时,债券成本不止表现在coupon, 还要考虑到PV和FV的差额。同样面值1000的债券,以800发行和以1200发行,对于债券发行人来说肯定不同,这部分也要考虑在发债的成本里。coupon rate 只体现了coupon的成本,YTM把两者都考虑到了。

YTM指的是以期初价格购买债券,并且此后收到债券所有的现金流核算出来的折现率。

因此,当我们说cost of debt时,指的是YTM。当债券以par value发行时, coupon rate=YTM, 所以可以直接用coupon rate, 这是一种特殊的例子。

虽然现在很辛苦,但努力过的感觉真的很好,加油!

NO.PZ2016021705000022 问题如下 t.Com hterminethit coulissue $1,000 favalue bon with 8 percent coupon paisemi-annually ana five-yematurity $900 per bon If t.Com’s margintrate is 38 percent, its after-tcost of is closest to: A.6.2 percent. B.6.4 percent. C.6.6 percent. is correct.FV = $1,000; PMT = $40; N = 10; PV = -$900Solve for i. The six-month yiel i, is 5.3149%YTM = 5.3149% × 2 = 10.62985% r (1−t) = 10.62985%(1−0.38) = 6.5905% r1 − t) = 10.62985%(1 − 0.38) = 6.5905% 为啥PV=900而不是1000

NO.PZ2016021705000022问题如下t.Com hterminethit coulissue $1,000 favalue bon with 8 percent coupon paisemi-annually ana five-yematurity $900 per bon If t.Com’s margintrate is 38 percent, its after-tcost of is closest to: A.6.2 percent.B.6.4 percent.C.6.6 percent. is correct.FV = $1,000; PMT = $40; N = 10; PV = -$900Solve for i. The six-month yiel i, is 5.3149%YTM = 5.3149% × 2 = 10.62985% r (1−t) = 10.62985%(1−0.38) = 6.5905% r1 − t) = 10.62985%(1 − 0.38) = 6.5905% 给出的coupon rate都是年化的吗

NO.PZ2016021705000022问题如下t.Com hterminethit coulissue $1,000 favalue bon with 8 percent coupon paisemi-annually ana five-yematurity $900 per bon If t.Com’s margintrate is 38 percent, its after-tcost of is closest to: A.6.2 percent.B.6.4 percent.C.6.6 percent. is correct.FV = $1,000; PMT = $40; N = 10; PV = -$900Solve for i. The six-month yiel i, is 5.3149%YTM = 5.3149% × 2 = 10.62985% r (1−t) = 10.62985%(1−0.38) = 6.5905% r1 − t) = 10.62985%(1 − 0.38) = 6.5905% 为啥pv是900,老师,我感觉我前面没有学好,能详细解答吗。感谢

NO.PZ2016021705000022 问题如下 t.Com hterminethit coulissue $1,000 favalue bon with 8 percent coupon paisemi-annually ana five-yematurity $900 per bon If t.Com’s margintrate is 38 percent, its after-tcost of is closest to: A.6.2 percent. B.6.4 percent. C.6.6 percent. is correct.FV = $1,000; PMT = $40; N = 10; PV = -$900Solve for i. The six-month yiel i, is 5.3149%YTM = 5.3149% × 2 = 10.62985% r (1−t) = 10.62985%(1−0.38) = 6.5905% r1 − t) = 10.62985%(1 − 0.38) = 6.5905% 这个是C以900元的价格发行到期日为1000的债券不是,所以当期获得900的现金流入,到期付出1000.

NO.PZ2016021705000022 问题如下 t.Com hterminethit coulissue $1,000 favalue bon with 8 percent coupon paisemi-annually ana five-yematurity $900 per bon If t.Com’s margintrate is 38 percent, its after-tcost of is closest to: A.6.2 percent. B.6.4 percent. C.6.6 percent. is correct.FV = $1,000; PMT = $40; N = 10; PV = -$900Solve for i. The six-month yiel i, is 5.3149%YTM = 5.3149% × 2 = 10.62985% r (1−t) = 10.62985%(1−0.38) = 6.5905% r1 − t) = 10.62985%(1 − 0.38) = 6.5905% RT