这题是不是少条件呀?还是和上面的一道题有关联?

企鹅_品职助教 · 2019年11月07日

27.4和27.5题有共同的题干:

Common text for questions following two questions:

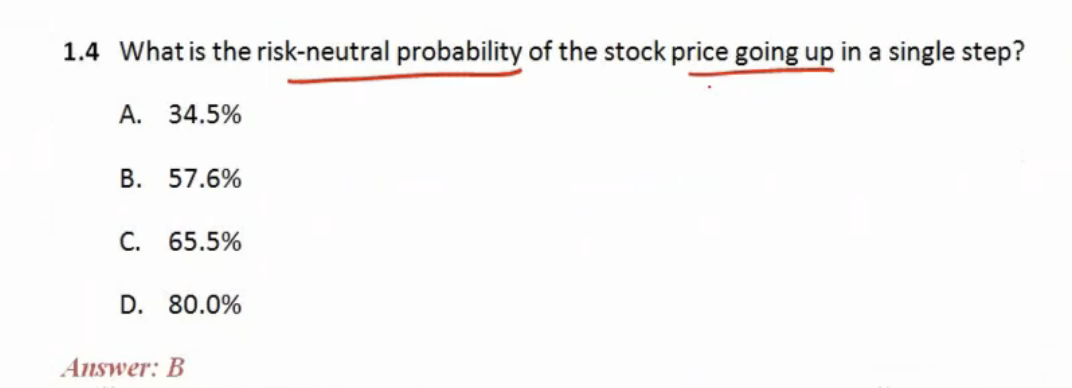

A risk manager for Bank XYZ, Mark is considering writing a 6 month American put option on a non-dividend paying stock ABC. The current stock price is USD 50 and the strike price of the option is USD 52. In order to find the no-arbitrage price of the option Mark uses a two-step binomial tree model. The stock price can go up or down by 20% each period. Mark’s view is that the stock price has an 80% probability of going up each period and a 20% probability of going down. The annual risk-free rate is 12% with continuous compounding.

我看了一下我答案版的讲义有这段话。无答案版的没有,我这就补充进去。谢谢同学提醒。