问题如下:

An analyst is addressing the following research topics: how investmentfund characteristics affect fund total returnsand whether stock and bond market returns explain thereturns of a portfolio of utility shares run by the firm.

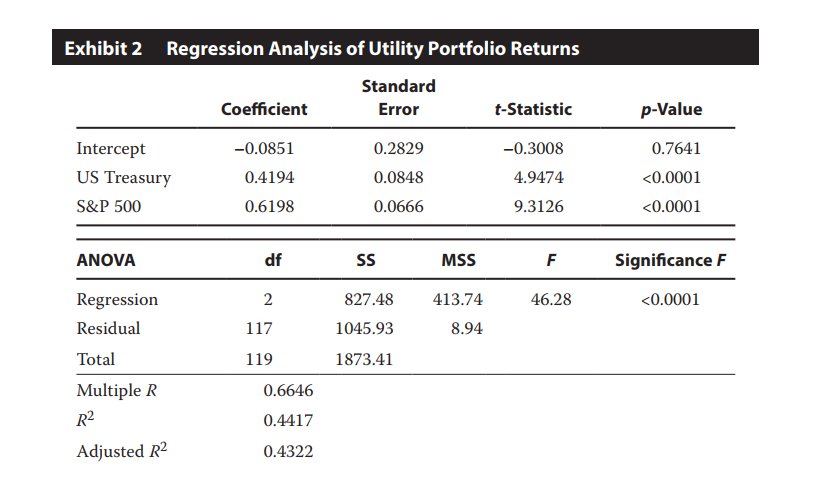

To explore the first topic, he usesthe average annualized rate of return(in percent) of 555 large-cap US equity fundsover the past five years. The independent variables are fund expenseratio, portfolio turnover, the natural logarithm of fund size, fund age, and threedummy variables.For the second topic, he establish whether bond marketreturns (proxied by returns of long-term US Treasuries) and stock market returns(proxied by returns of the S&P 500 Index) explain the returns of a portfolio of utilitystocks being recommended to clients.

Whether he should have estimated the models using a probit or logit model instead of using a traditional regressionanalysis?

选项:

A.Both should be estimated with probit or logit models.

Neither should be estimated with probit or logit models.

Neither should be estimated with probit or logit modelsOnly the analysis in Exhibit 1 should be done with probit or logit models.

解释:

Probit and logit models are used for models with qualitativedependent variables, such as models in which the dependent variable canhave one of two discreet outcomes (i.e., 0 or 1). The analysis in the twoexhibits are explaining security returns, which are continuous (not 0 or 1)variables.

看解析说有两个exhibits? 上一个回答里只贴了Exhibit 1