问题如下:

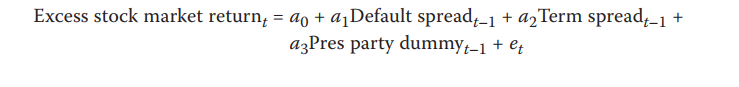

\(\begin{array}{l}Excess\text{ }stock\text{ }market\text{ }return_t\\=a_0+a_1Default\text{ }spread_{t-1}\text{ }+a_2Term\text{ }spread_{t-1}\text{ }+a_3Pres\text{ }party\text{ }dummy_{t-1}\text{ }+e\end{array}\)

Default spread is equal to the yield on Baa bonds minus the yield on Aaa bonds. Term spread is equal to the yield on a 10-year constant-maturity US Treasury index minus the yield on a 1-year constant-maturity US Treasury index. Pres party dummy is equal to 1 if the US President is a member of the Democratic Party and 0 if a member of the Republican Party.

The regression is estimated with 431 observations.

Exhibit 1.Multiple Regression Output

Exhibit 2. Critical Values for the Durbin–Watson Statistic (α= 0.05)

At a 0.05 level of significance, the test for serial correlation indicates that there is:

选项:

A.no serial correlation in the error term.

B.positive serial correlation in the error term.

C.negative serial correlation in the error term.

解释:

B is correct.

The Durbin–Watson test used to test for serial correlation in the error term, and its value reported in Exhibit 1 is 1.65. For no serial correlation, DW is approximately equal to 2. If , the error terms are positively serially correlated. Because the DW = 1.65 is less than for n = 431 (see Exhibit 2), Chiesa should reject the null hypothesis of no serial correlation and conclude that there is evidence of positive serial correlation among the error terms.

这个题目中的公式无法正常显示。