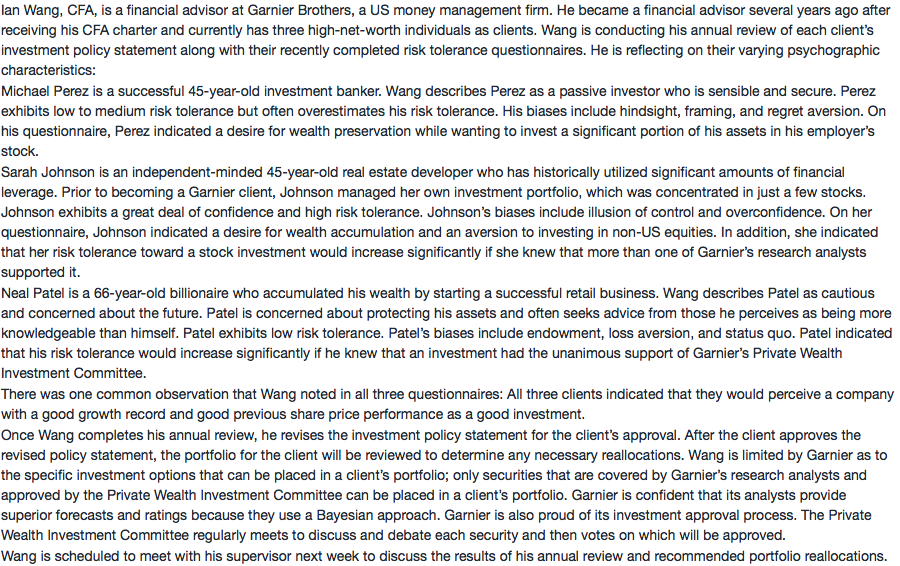

问题如下:

Which investment portfolio is least likely to deviate from the mean–variance portfolio?

选项:

A.Patel.

B.Perez.

C.Johnson.

解释:

B is correct.

Perez has primarily cognitive error biases. Accordingly, it is likely that, with education, the impact of these biases can be reduced or even eliminated. Because cognitive biases dominate, Wang should seek to moderate the effect of these biases and adopt a program to reduce or eliminate the bias rather than accept the bias. The result will be a portfolio that is similar to the mean–variance portfolio.

能否解释一下这道问题及答案?有点没听懂