问题如下:

The table provides relevant information about four bonds in a portfolio, based on the table, the price value of a basis point for this portfolio is close to?

选项:

A.$65,341.15.

B.$77,518.65.

C.$73,124.38.

D.$72,647.90.

解释:

D is correct

考点:Bond Duration-DV01

解析:

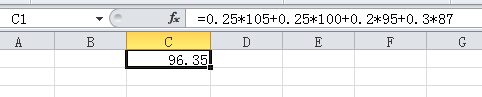

effective duration=7.54

x 0.0001 x 96.35×1000000 = $72,647.9

这道题的用effective duration进行计算,但是每个effetive的比例用市值计算(25/100)这样

但是计算出来的effective duration应该是7.5850吧?

烦请展示计算过程