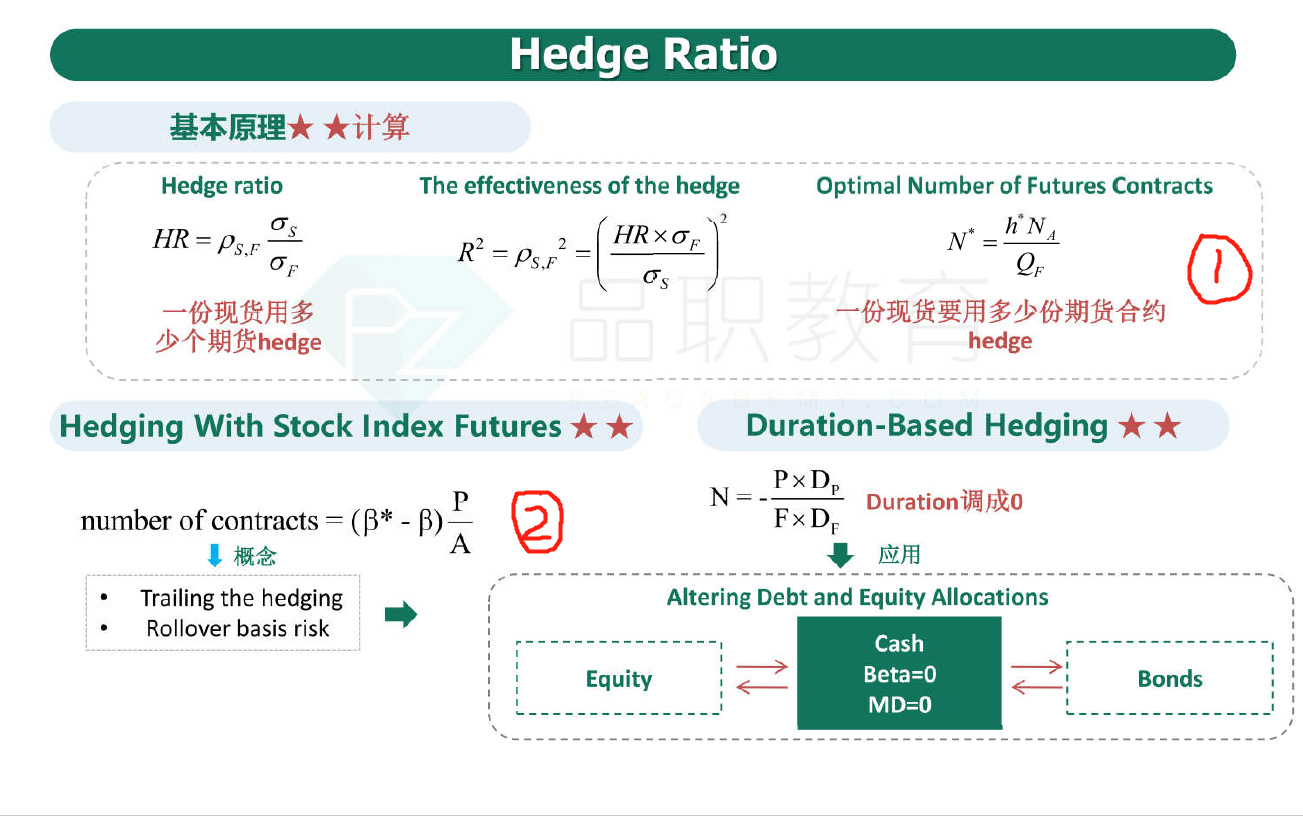

解析里N*=-B*S/F,但推出的公式不应是N*=-B*ns/Qf ?(ns为现货数量,Qf为一份期货合约含的标的数量?)。可以认定为S与ns、F与Qf是一回事?问题如下图:

选项:

A.

B.

C.

D.

解释:

orange品职答疑助手 · 2019年08月23日

同学你好,不可以。有两个算合约数量的公式。这两个公式我觉得挺容易搞混的,我后来去仔细看了金融工程的书,这两个公式的h和β虽然都是线性回归来的,但在做回归时用的变量其实不一样。前者的变量是价格,后者的变量是收益率。所以公式是不一样的。

但不用知道这么细,只要区分,普通的期货对冲来算对冲比率或者合约数量,用的是第一个公式,即h乘上两个数量之比;但如果算股指期货对冲,那就是用第二个公式,对冲比率乘上的是两个价值之比

ZF Everyday · 2021年03月14日

请问老师的ppt在哪里有?我在产品的基础讲义和强化中都没找到这一页?

NO.PZ2016082404000024问题如下 You have a portfolio of US5 million to heeusing inx futures. The correlation coefficient between the portfolio anfutures being useis 0.65. The stanrviation of the portfolio is 7% anthof the heing instrument is 6%. The futures priof the inx futures is US1,500 anone contrasize is 100 futures. Among the following positions, whione reces risk the most? Long 33 futures contracts Short 33 futures contracts Long 25 futures contracts Short 25 futures contracts ANSWER: o hee, the portfolio manager shoulsell inx futures, to create a profit if the portfolio loses value. The portfolio beta is 0.65×7%6%=0.758.0.65\times\frac{7\%}{6\%}=0.758.0.65×6%7%=0.758.The number of contracts is N∗=−βSF=−(0.758×5,000,000)1,500×100=−25.3N\ast\text{=}-\beta\frSF=\frac{-{(0.758\times5,000,000)}}{1,500\times100}\text{=}-25.3N∗=−βFS=1,500×100−(0.758×5,000,000)=−25.3 or 25 contracts.5mx1+0.758*150000*Nf=0,这才是正确的公式啊

NO.PZ2016082404000024问题如下 You have a portfolio of US5 million to heeusing inx futures. The correlation coefficient between the portfolio anfutures being useis 0.65. The stanrviation of the portfolio is 7% anthof the heing instrument is 6%. The futures priof the inx futures is US1,500 anone contrasize is 100 futures. Among the following positions, whione reces risk the most? Long 33 futures contracts Short 33 futures contracts Long 25 futures contracts Short 25 futures contracts ANSWER: o hee, the portfolio manager shoulsell inx futures, to create a profit if the portfolio loses value. The portfolio beta is 0.65×7%6%=0.758.0.65\times\frac{7\%}{6\%}=0.758.0.65×6%7%=0.758.The number of contracts is N∗=−βSF=−(0.758×5,000,000)1,500×100=−25.3N\ast\text{=}-\beta\frSF=\frac{-{(0.758\times5,000,000)}}{1,500\times100}\text{=}-25.3N∗=−βFS=1,500×100−(0.758×5,000,000)=−25.3 or 25 contracts.这里公式直接负贝塔,是因为目标贝塔为0,贝塔*是0,所以直接代公式看结果正负就行了,这么理解对吗?

NO.PZ2016082404000024 问题如下 You have a portfolio of US5 million to heeusing inx futures. The correlation coefficient between the portfolio anfutures being useis 0.65. The stanrviation of the portfolio is 7% anthof the heing instrument is 6%. The futures priof the inx futures is US1,500 anone contrasize is 100 futures. Among the following positions, whione reces risk the most? Long 33 futures contracts Short 33 futures contracts Long 25 futures contracts Short 25 futures contracts ANSWER: o hee, the portfolio manager shoulsell inx futures, to create a profit if the portfolio loses value. The portfolio beta is 0.65×7%6%=0.758.0.65\times\frac{7\%}{6\%}=0.758.0.65×6%7%=0.758.The number of contracts is N∗=−βSF=−(0.758×5,000,000)1,500×100=−25.3N\ast\text{=}-\beta\frSF=\frac{-{(0.758\times5,000,000)}}{1,500\times100}\text{=}-25.3N∗=−βFS=1,500×100−(0.758×5,000,000)=−25.3 or 25 contracts. The futures priof the inx futures is US1,500 anone contrasize is 100 futures中one contrasize is 100 futures是指的一份 inx futures中包含100个小的futures吗?就是那个乘数是吗?

NO.PZ2016082404000024 问题如下 You have a portfolio of US5 million to heeusing inx futures. The correlation coefficient between the portfolio anfutures being useis 0.65. The stanrviation of the portfolio is 7% anthof the heing instrument is 6%. The futures priof the inx futures is US1,500 anone contrasize is 100 futures. Among the following positions, whione reces risk the most? Long 33 futures contracts Short 33 futures contracts Long 25 futures contracts Short 25 futures contracts ANSWER: o hee, the portfolio manager shoulsell inx futures, to create a profit if the portfolio loses value. The portfolio beta is 0.65×7%6%=0.758.0.65\times\frac{7\%}{6\%}=0.758.0.65×6%7%=0.758.The number of contracts is N∗=−βSF=−(0.758×5,000,000)1,500×100=−25.3N\ast\text{=}-\beta\frSF=\frac{-{(0.758\times5,000,000)}}{1,500\times100}\text{=}-25.3N∗=−βFS=1,500×100−(0.758×5,000,000)=−25.3 or 25 contracts. 为什么0.758是portfolio的beta呢,这不应该是hee ratio 吗,原portfolio的beta应该和对冲工具没有关系啊,谢谢

NO.PZ2016082404000024 You have a portfolio of US5 million to heeusing inx futures. The correlation coefficient between the portfolio anfutures being useis 0.65. The stanrviation of the portfolio is 7% anthof the heing instrument is 6%. The futures priof the inx futures is US1,500 anone contrasize is 100 futures. Among the following positions, whione reces risk the most? Long 33 futures contracts Short 33 futures contracts Long 25 futures contracts Short 25 futures contracts ANSWER: To hee, the portfolio manager shoulsell inx futures, to create a profit if the portfolio loses value. The portfolio beta is 0.65×7%6%=0.758.0.65\times\frac{7\%}{6\%}=0.758.0.65×6%7%=0.758.The number of contracts is N∗=−βSF=−(0.758×5,000,000)1,500×100=−25.3N\ast\text{=}-\beta\frSF=\frac{-{(0.758\times5,000,000)}}{1,500\times100}\text{=}-25.3N∗=−βFS=1,500×100−(0.758×5,000,000)=−25.3 or 25 contracts. 老师讲了N>0应该是long,不知道这么理解对不对