请问有了capital imit, 为什么还有position limit 有什么区别呢。

Wendy_品职助教 · 2019年06月03日

这道题出的不太好, 不是常规的考法,position limit 和stop-loss limit也根本用不到,题目也没说这是什么意思。

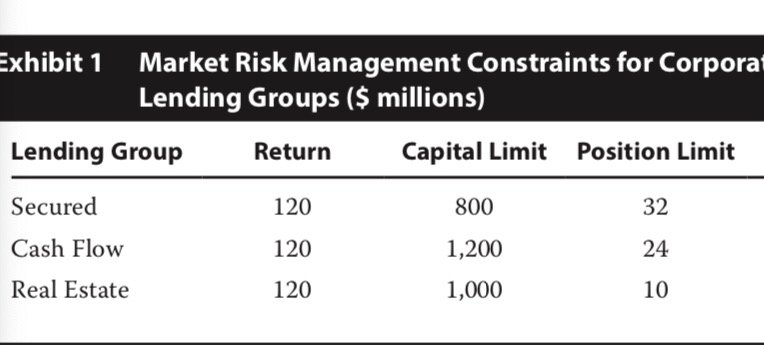

Klink responds by stating that the corporate banking division’s capital allocation is $2,800 million. This amount considers market risk, credit risk, and operational risk for which the minimum required return is 11%. Capital limits, position limits, and stop-loss limits are assigned to manage both overall exposure and exposure to single-name event risk.

其实这道题描述的意思是:

capital limit 衡量的是 overall exposure (market risk, credit risk, and operational risk)

注意题目的问题:With respect to capital allocation, which lending group listed in Exhibit 1 is least likely attractive?

其实已经明示我们用capital allocation 的return进行比较,是否满足了 minimum required return is 11%的要求。