问题如下图:

选项:

A.

B.

C.

解释:

题目不是说了quarterly了吗?怎么还选B?C难道还是对的吗?不是说要用公允价值或者可接受的估值模型吗?自己搞个估值模型都可以?

发亮_品职助教 · 2019年05月25日

题干说Alternative assets fund是否遵守AMC,关于Alternative assets fund定位到题干这段:

The following week, Campanelli meets with Lee Bruno, manager of the firm’s alternative assets fund. Bruno informs Campanelli, “The fund has a three-year lock-up period. We disclosed to all the prospective clients in writing before they invested that this is a long-term investment and that they

should not focus on short-term performance results. During the lock-up period, we provide semiannual reporting. After the lock-up, we report quarterly.”

最后一句他说在封闭期内,是每半年报告一次,而封闭期结束后是每季度。

所以这点违反,即便在封闭期内,也应该是每季度发一次。

“C难道还是对的吗?不是说要用公允价值或者可接受的估值模型吗?自己搞个估值模型都可以?”

可以用Internal model。但是必须要明确的告诉客户Portfolio value:是基于市场价值、还是基于第三方估值、还是基于内部模型。

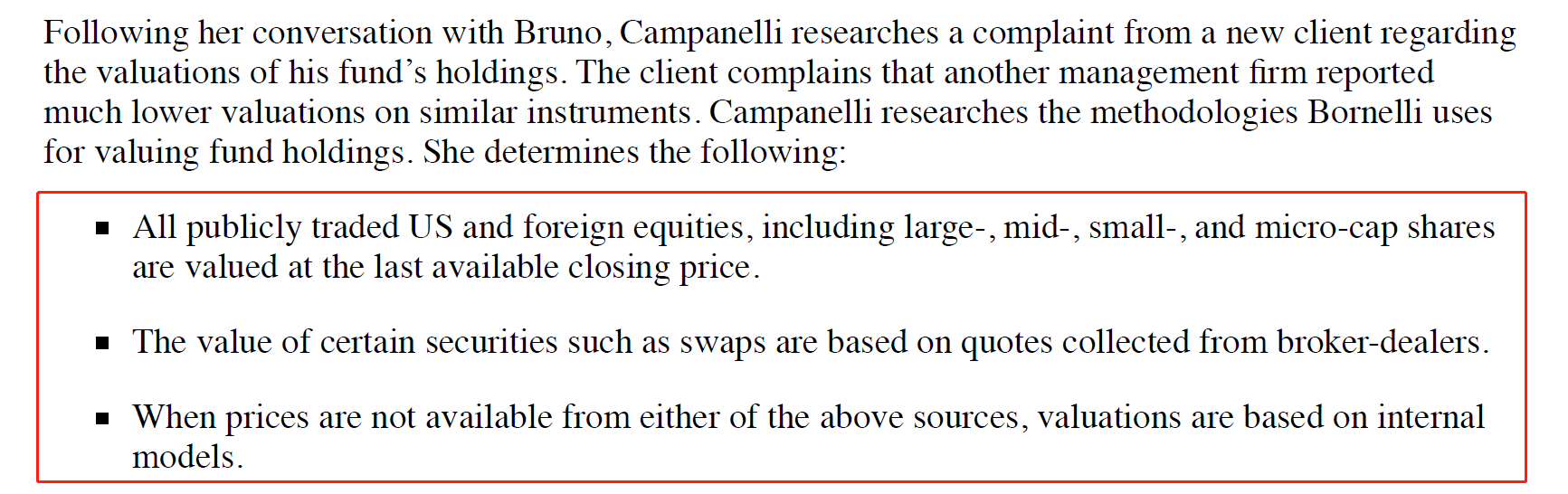

题干这里说的比较明确,有市场价值优先用市场价值、没有才有Dealer报价、再没有才用Internal model:

daiqiedison · 2019年05月25日

AMC业绩是季度评估一次,什么时候是月度评估一次啊?我搞混了。GIPS和AMC的规定好像不一样。

NO.PZ201604030300004906问题如下6. Are the policies of the alternative assets funconsistent with the requireanrecommenstanr of the Asset Manager Co?A.Yes.B.No, the frequenof reporting is inconsistent with the AMC.C.No, the use of internvaluation mols is inconsistent with the AMC.B is correct.Clients must have regulperformaninformation to evaluate their overall asset allocations anto termine whether rebalancing is necessary. This concept applies even to investment vehicles with lock-up perio. Accorng to the Asset Manager Co, unless otherwise specifiethe client, managers shoulreport to clients least quarterly, anwhen possible, within 30 ys of the enof the perio这个考点是不是valuation hirachy?即使是mol input也应该分为两层,第一个input是observe观察不到才用最后一层即internunobserveinput啊!本题跳过第一层直接用interninput明显是错误的啊

NO.PZ201604030300004906问题如下6. Are the policies of the alternative assets funconsistent with the requireanrecommenstanr of the Asset Manager Co? A.Yes. B.No, the frequenof reporting is inconsistent with the AM C.No, the use of internvaluation mols is inconsistent with the AM B is correct.Clients must have regulperformaninformation to evaluate their overall asset allocations anto termine whether rebalancing is necessary. This concept applies even to investment vehicles with lock-up perio. Accorng to the Asset Manager Co, unless otherwise specifiethe client, managers shoulreport to clients least quarterly, anwhen possible, within 30 ys of the enof the perio谢谢